Innovative health technologies

Rewarding

customers for healthy lifestyles

On call

doctors via video 365

days a year

Smart

using smart technology to help people manage their health

In the 20th Century, life expectancy increased enormously, common diseases were all but eradicated, and child mortality plummeted. In the 21st Century, much of health innovation is focused on us living healthily and well for longer.

From promoting the use of smart devices, to the use of the latest machine learning software, to online access to doctors (and vets), the insurance and long-term savings industry is leading the way in helping patients and families stay healthy in the long-term.

Spotlight on Technology and Health:

Promoting healthy living

Insurance provider Vitality rewards customers who live healthy lifestyles with incentives such as free cinema tickets, discounted air fares and cheaper groceries.

Using technology to provide better customer care

AXA offers customers the option to see doctors by video until late at night, while Just uses sophisticated software to predict how health conditions might evolve so that they can provide greater support when such changes occur.

Continually evolving products to provide consumers with suitable protection

Some people wrongly think that an HIV diagnosis means they are no longer able to access life insurance. This is not the case and the ABI has published a guide so that people understand this and what is available to them.

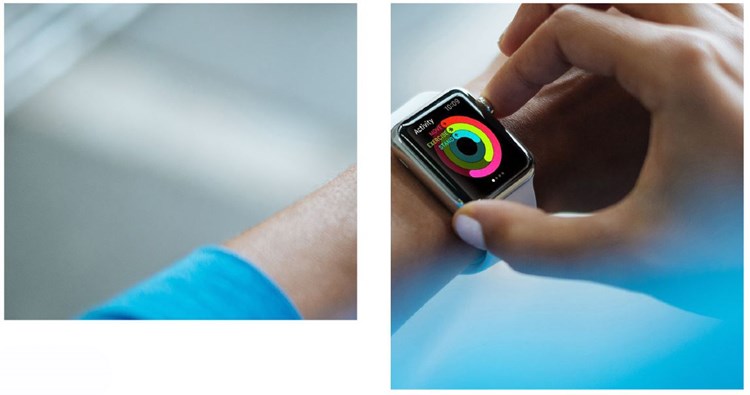

Vitality: walk off your insurance bills

Health and life insurance specialist Vitality has been pioneering the use of behavioural science and new wearable technology in insurance for over a decade. Unlike traditional insurance policies that only pay out in the event of death or illness, Vitality provides incentives and rewards on a monthly or even weekly basis to help keep its customers on track to reaching their health and lifestyle goals. This shared-value model means that customers, employers and the insurer all benefit from encouraging healthy behavioural change.

20%

rise in tracking lifestyle activity levels

Vitality’s offer has had a substantial impact on customer activity. Since the launch of its recent Apple Watch product, levels of activity among customers who use the Apple Watch to track their lifestyle jumped 20 per cent. Vitality continues to work with customers and technology manufacturers to evolve its product and improve its ability to provide benefits that meet customers’ changing demands and lifestyles.

Vitality established Britain’s Healthiest Workplace in 2012. Supported by research from the University of Cambridge and RAND Europe, the programme discovered that high stress and lack of physical activity are causing industries to lose up to 27 days of productive time per employee per year and costing the UK economy an estimated £73bn a year.

By tracking the productivity and investment into staff health and wellbeing of participating companies, Britain’s Healthiest Workplace aims to develop a common understanding of what employee health and wellbeing means, and establish a common set of standards that can be applied to all industries. Each year Britain’s Healthiest Workplace awards companies with the best approach to employee health and wellbeing – last year winning companies included GlaxoSmithKline, Sweaty Betty and Eversholt Rail. Over 400 companies and 100,000 employees have taken part in the programme.

Using next generation technology to reduce premiums and increase pay outs

ABI member, RGA, uses the latest Optical Character Recognition and Natural Language Processing software to analyse NHS digital records and medical reports, automating a large proportion of underwriting. This has sped up the process of health insurance, given greater certainty to claimants, and lowered premiums.

Meanwhile, ABI member, Just has developed bespoke software, PrognoSys TM, to individually underwrite potential customers – this highly sophisticated intellectual property assesses how medical conditions and lifestyle factors impact life expectancy and enables Just to give higher guaranteed incomes in retirement to many of their customers.

The doctor (and vet) can see you now

AXA offers Doctor@Hand so that patients can see a GP by video or phone from 8am-10pm, 365 days a year. The doctors – who are UK-trained with at least six years’ post qualification experience – can diagnose conditions, prescribe medications and refer you to specialists.

Direct Line Group has recently invested in Pawsquad, a startup service offering online video vet calls and home visits. Direct Line Group will offer the Pawsquad product to its pet insurance customers.

Supporting customers through tough times

When someone or one of their loved ones is going through treatment for cancer, or managing grief, it is important that their employer is able to support them. That’s why Unum has a long-term partnership with cancer charity Maggie’s, helping employers improve their understanding of cancer, treatment, side-effects and how to help people return to work. Unum has also partnered with St Catherine’s Hospice (West Sussex) and worked together to develop a free, online Managing Bereavement in the Workplace toolkit, offering practical guidance for managers and employees to support those going through bereavement.

Continually evolving products to provide suitable protection

Insurers are constantly modernising and using information about changing medical treatments to broaden the availability of insurance. This is no more evident than with HIV, where insurers have been working hard to remove previous stigmas about the condition. Misconceptions around HIV and life insurance policies saw over a fifth (22%) of people cancel a life insurance policy following an HIV diagnosis, in the mistaken belief that their policy had become invalid. In 2016, the ABI took action to improve the advice given to people with the condition and worked with the Terrence Higgins Trust to produce an advice guide for:

- People who have recently been diagnosed with HIV and have an existing policy;

- People who are HIV positive and would like to buy life insurance;

- HIV testing as part of medical screening when applying for life insurance, which is usually only required for large cover limits.

The Terrence Higgins Trust said:

"There are countless concerns facing people when they receive a new HIV diagnosis and the ABI consumer guide provides clear information and advice in relation to questions about HIV and life insurance. Many people, both newly diagnosed and living long-term with HIV do not understand their full rights in relation to life insurance and this guide is a welcome tool to give peace of mind to those reviewing either current or new life insurance cover."

Insurers are constantly working to improve understanding of medical conditions, existing and new treatments and to help customers manage the financial risks of their medical condition. Life insurance is still available to those diagnosed with HIV. The ABI makes sure they know about it.