Using FinTech to simplify long-term savings

11

different pensions pots for the average retired person

60m

UK pension pots

Powering

innovation

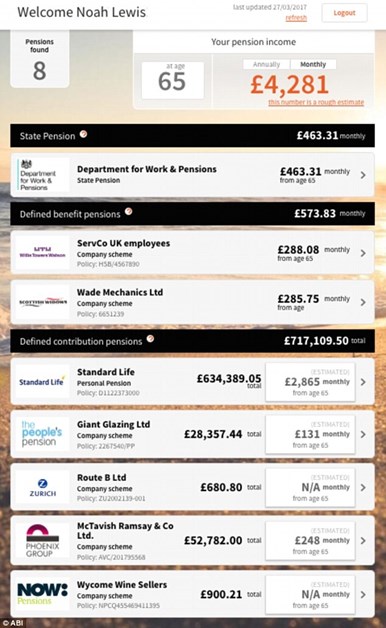

Our industry constantly adapts and evolves its long-standing products to meet our customers changing needs. A group of pension providers has been working with Government, regulators and technology companies to create new services which will allow everyone in the UK to see information about all of their pension pots together, in an online place of their choosing. The ABI has been project managing key parts of this work.

As the UK faces the challenges of an ageing society and the need for many people to have longer working lives, the importance of helping people plan for their futures is the focus of much of the work on creating pensions dashboards. We know the public find pension issues, and the challenge of planning for their own retirement, incredibly complex. The introduction of new pension flexibilities in 2015, giving individuals more personal responsibility for their retirement choices, has added to this but made it even more important that a solution is found.

Working alongside a range of FinTech development partners, the long-term savings sector is creating the technology to show the pension information for an individual from all of their various schemes and providers, including the State Pension, in one place. The dashboard services will look to access – in time – over 60 million pension pots in the UK. The Government’s objective is for the service to be available to consumers by 2019 and for it to be offered by a range of different organisations rather than by a single, central service. This means that the work by the long-term savings sector to support the creation of the underlying technology will enable other industries to innovate and offer new services to consumers.

The long-term savings sector and FinTech firms working side-by-side

Collaboration between the long-term savings sector and FinTech partners from across the UK has already resulted in the successful creation of a pensions dashboard prototype, which was demonstrated to Government ministers in March 2017. To help inform the next stages of development, eighty people from twenty leading technology firms, consumer groups and the industry took part in a TechSprint, held as part of HM Treasury’s FinTech week. Within 18 hours, several teams had demonstrated the potential of programming Amazon’s Alexa to hold a conversation about your pension; shown they could build chat bots to deliver guidance tailored to specific life events; and proposed new services that displayed financial data in a similar way to physical health data generated by fitness trackers. Each of these demonstrated a fundamental reshaping of retirement communications, harnessing advances in big-data, the Internet of Things (IoT) and Artificial Intelligence to improve consumers’ retirement prospects.

Before the service can go live in 2019 the ABI and pension providers will be continuing their work with Government, regulators and the FinTech sector to research customer needs, establish what features will be most valuable and develop the important technical data standards firms will need to meet. This collaboration has the potential to transform how UK consumers engage with their retirement options.