Innovation in the retirement market

Achieving

good retirement outcomes

Innovating

products and processes

Engaging

through technology

The introduction of pension freedoms in 2015 brought about fundamental changes to the way consumers access their pension savings. As highlighted in ‘The New Retirement Market: Challenges and Opportunities’, there is a wide range of retirement products on offer to meet the diverse needs and aims of consumers. While the interim report of the FCA’s Retirement Outcomes Review suggested that product innovation has been limited to date, this webpage demonstrates how ABI members and industry are already developing a variety of innovative products, processes and services to help customers achieve a comfortable retirement.

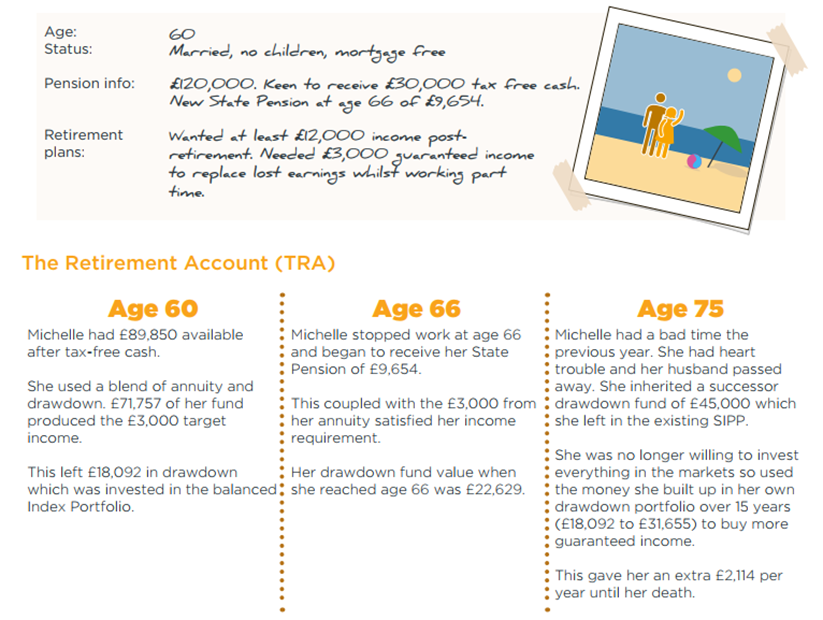

Retirement Advantage: The Retirement Account

The Retirement Account is a product that helps customers manage their retirement income by combining savings, guaranteed income, flexible income and a cash account all within a single tax-advantaged wrapper. This combination offers greater flexibility and tax control around income, investment and death benefits. Customers have the ability to take a tax-free lump sum on a phased basis and the product allows customers to reduce, stop or start their guaranteed income at any time.

LV=: The Robo paraplanner

The Robo paraplanner is an efficient telephone advice service that makes advice accessible to all customers, regardless of pot size. It improves efficiency for telephone advisers by combining algorithms developed from the industry-first, LV= Retirement Wizard, together with expert financial planning, so they are able to ask customers the right questions to automate a tailored and adviserguided retirement journey. The combination of automated and human elements results in a much more streamlined advice process for customers, for example with the production of an advice report within minutes after the call.

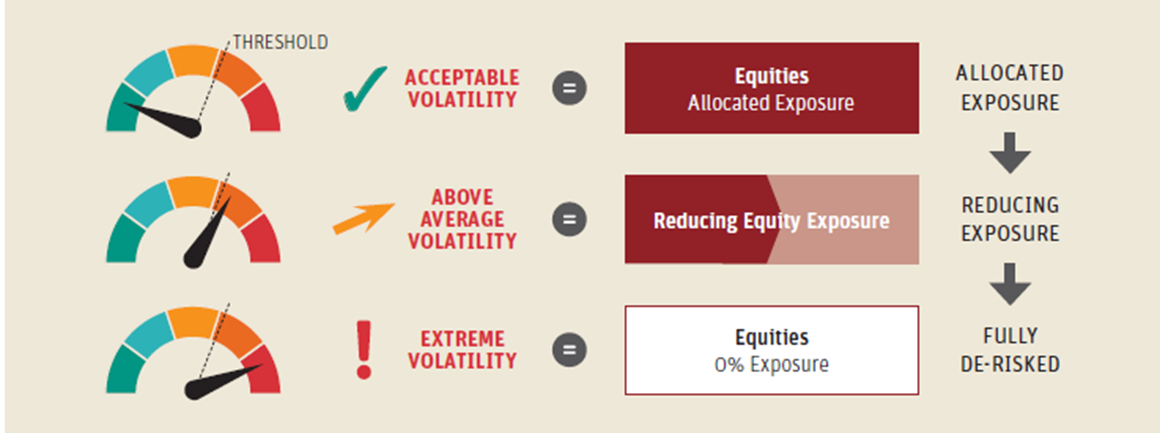

Scottish Widows: Dynamic Volatility Management

Scottish Widows’ new Retirement Portfolio Funds uses algorithms to lower the risk of capital loss for income drawdown customers if equity volatility becomes significant. The innovative system can detect periods of significant volatility, helping to both lower the risk and keep costs down for customers.

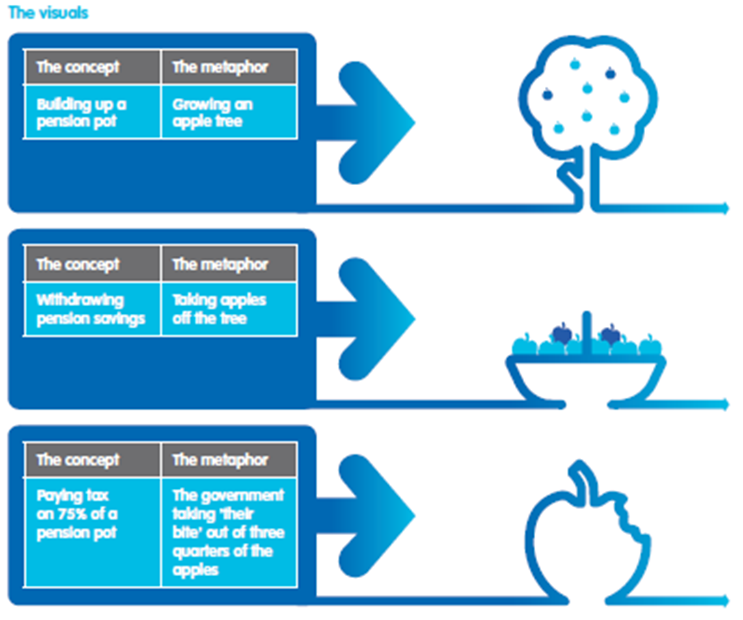

B&CE: Retirement Options Language

B&CE are removing jargon from their retirement communications by replacing them with practical labels, visual aids and metaphors instead. By explaining the process using everyday terminology, B&CE’s communications are more engaging, easy-to-understand

and relatable. A good example is their use of a growing tree to represent how a pension pot grows, and taking apples off the tree to demonstrate the many ways a pension can be accessed.

Scottish Widows: Employee Digital Service

Scottish Widows’ Employee Digital Service is a platform that allows scheme members to have key information about their pension at their fingertips. With this informing and engaging digital service, employees can log in to see information about their policy and use simple tools and calculators to help them save for retirement and take control of their financial futures.

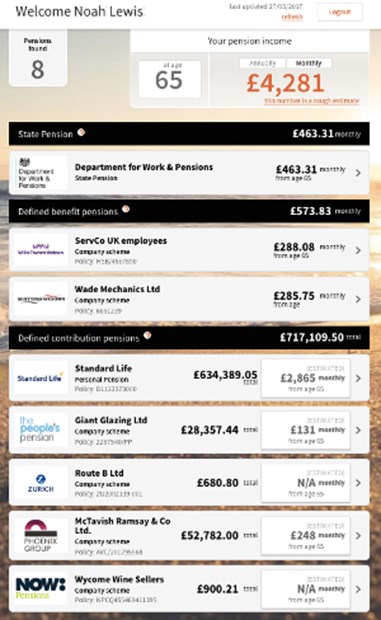

Industry: The Pensions Dashboard

Pensions dashboards will allow an individual to see all of their pension pots together online – all in one place. Collaboration between the long-term savings sector and FinTech partners from across the UK resulted in the successful creation of a pensions dashboard prototype led by the ABI. The dashboard project interim report recommends the right for consumers to access information about all of their pensions in a place of their choice in a standardised digital format, via regulated services. It is the Government’s objective for the service to be available by 2019.