Background

Pillar One of our Climate Change Roadmap focuses on the actions our members need to take to align their portfolios to Net Zero – focussing on the ‘financed emissions’ that are linked to investment and underwriting activity.

This pillar outlines how the sector will meet its commitment to reaching Net Zero by 2050 - in line with the Long-Term Global Goal (LTGG) agreed in Article 2.1 of the Paris Agreement and reaffirmed at COP26 and to halving our emissions by 2030, in line with the conclusions of the IPCC's Mitigation report, published in April 2022.

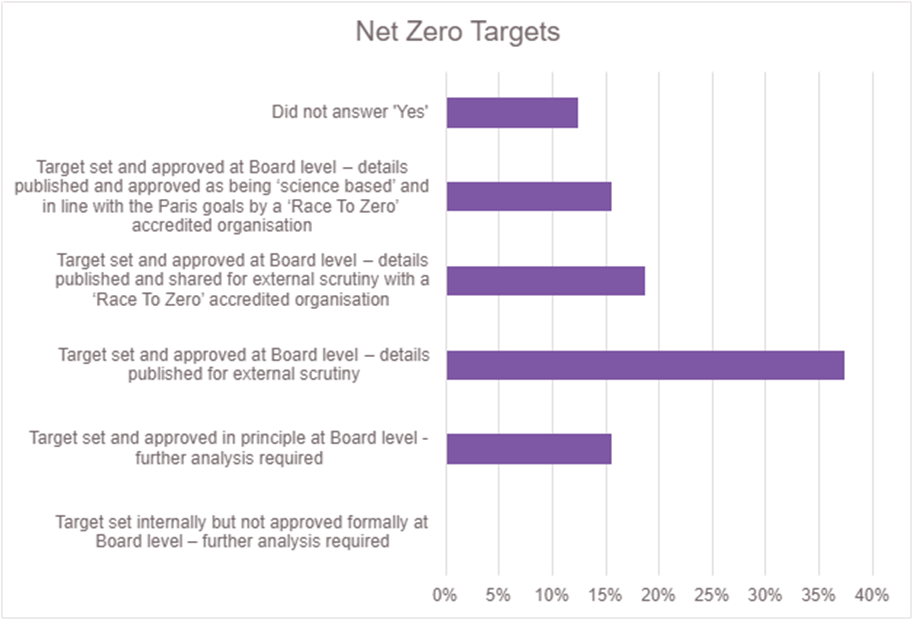

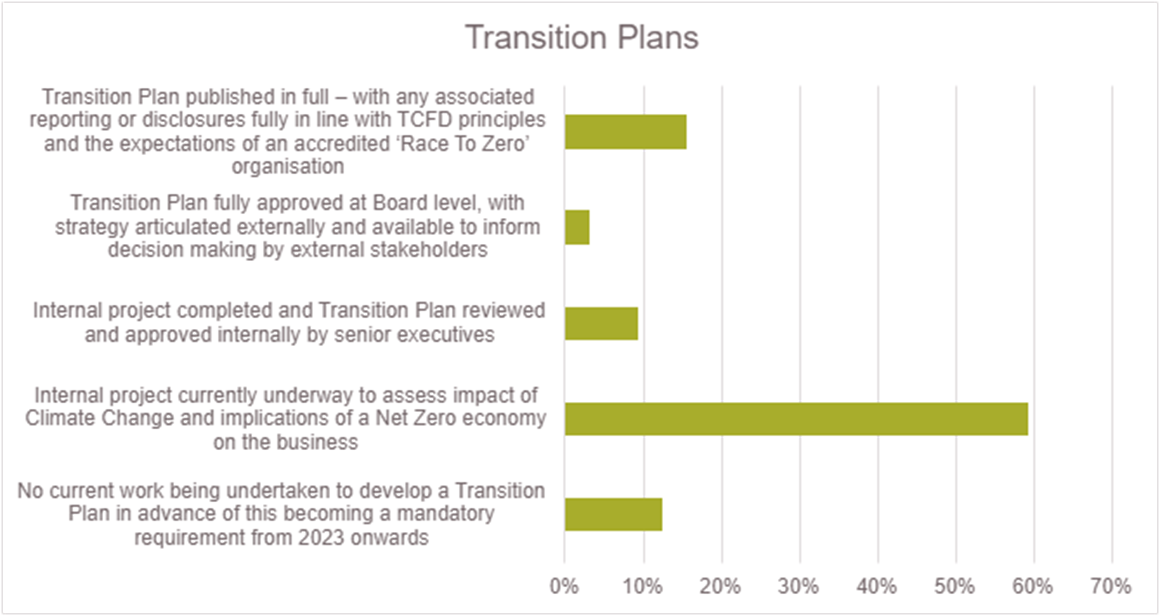

This pillar emphasises the importance of transparency and external scrutiny. This is how climate change experts can scrutinise whether the commitments our members are making are credible and how our stakeholders can ensure the actions we are taking align with Net Zero strategies in the wider economy.

To achieve this, we recommend our members join an organisation that has been accredited by the UN-backed Race To Zero campaign.

‘Race To Zero’ is a global campaign to rally leadership and support from businesses, cities, regions, universities and investors for a healthy, resilient, zero carbon recovery that prevents future threats, creates decent jobs and unlocks inclusive, sustainable growth.

Initiatives our members can join include one of the Glasgow Financial Alliance for Net Zero (GFANZ) groups, or related initiatives like the SBTi (Science Based Targets initiative)’s Business Ambition for 1.5 campaign or the IIGCC (Institutional Investors Group on Climate Change)’s Paris Aligned Investment Initiative.

Membership of ClimateWise also allows insurance companies to benchmark themselves against their peers, including through the annual Independent Review of the ClimateWise Principles. The ABI was a founding member and we publish our own ClimateWise.

In addition, our Roadmap sets out a series of milestones that we expect our members to achieve by 2025 – these are particularly important as they are within the tenure of the industry’s current leadership.

The group of industry CEOs who developed our Roadmap have consistently emphasised the need for milestones they can personally be held to account for, to ensure that their businesses are able to meet the longer-term 2030 and 2050 targets.

Progress Update

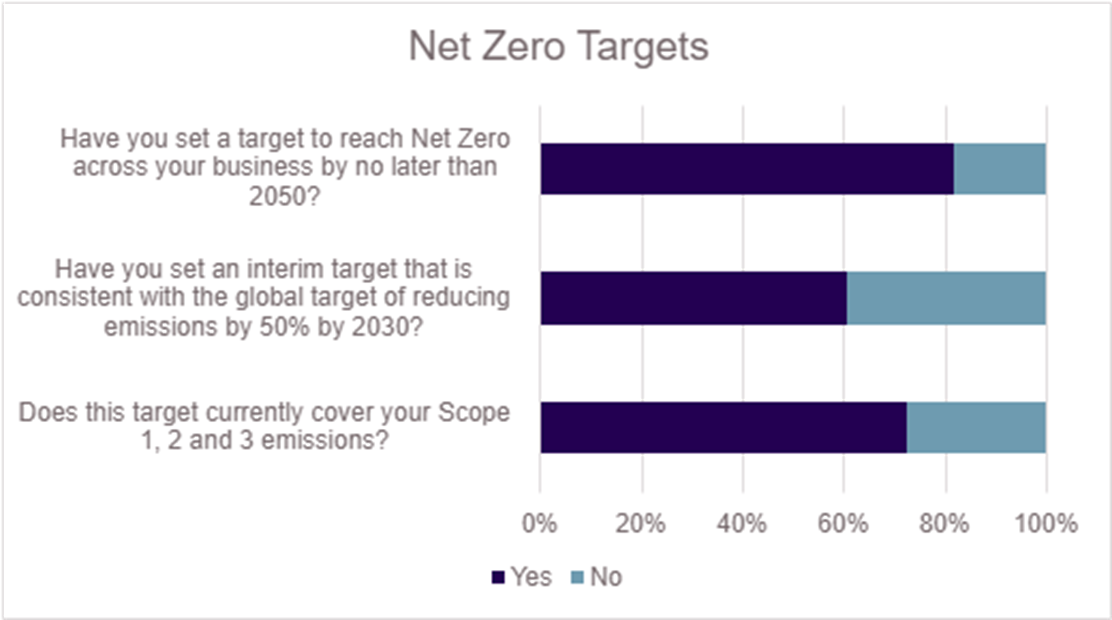

Net Zero Targets