Insurance industry publishes benchmark data on diversity for the first time

The most comprehensive survey ever carried out of talent and diversity in the insurance and long-term savings sector has revealed a majority of firms already have programmes in place to promote inclusion at the very top of their businesses.

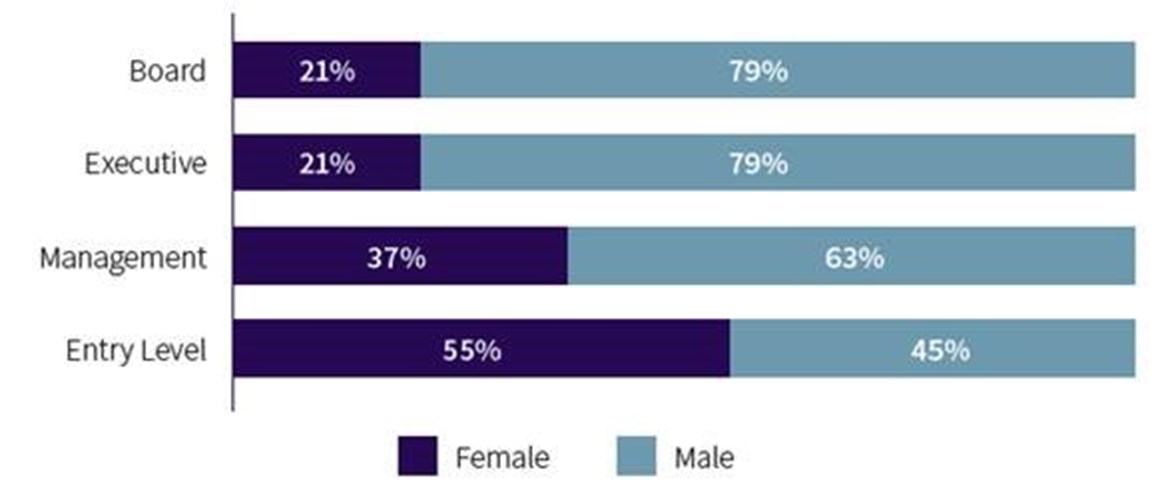

The data collection, undertaken by the Association of British Insurers (ABI) and published the day before the organisation’s Annual Conference, also demonstrates the scale of the challenge faced by the industry when it comes to getting women into top posts.

Headline findings of the ABI’s research, which is based on a data collection covering more than 82,000 staff, include:

- 78% of companies have a diversity and inclusion strategy, with 74% having an executive sponsor for diversity and inclusion.

- 73% of firms have an executive or management development programme that prioritises good gender balance, while 56% have a development programme targeting those that may be underrepresented.

- 78% of companies have already provided unconscious bias training for staff.

- For parents, 33% of firms have a returnship programme to help them with their return to work.