Matt Cullen, Assistant Director, Head of Strategy, ABI

Matt Cullen, Assistant Director, Head of Strategy, ABI“We’re the first generation to feel the impact of climate change and the last generation that can do something about it” - an encouraging surprise, perhaps, that this resonant statement was first made by an American – Governor Jay Inslee of Washington State if you’re interested – and was repeated in a 2014 speech by President Obama.

Obama was speaking at the start of a long lead-in to a UN Climate Conference in Paris in December, where dignitaries from around the world will aim to sign a robust global deal on managing climate change. Much has been made of the importance of success in these negotiations. Experts argue that, following the failure of talks in Copenhagen five years ago to agree a global policy framework to reduce carbon emissions, Paris is ‘last chance saloon’ for preventing irreversible and harmful shifts in our climate.

So 2015 is a really important year for international climate change policy, and it’s a relief to see that the UK Government’s position is in the right place – engaged and ahead of the curve on setting ambitious and legally binding emissions targets. The public mandate for such a position has been broadly growing since the turn of the millennium, and you only have to look out of the window to understand why.

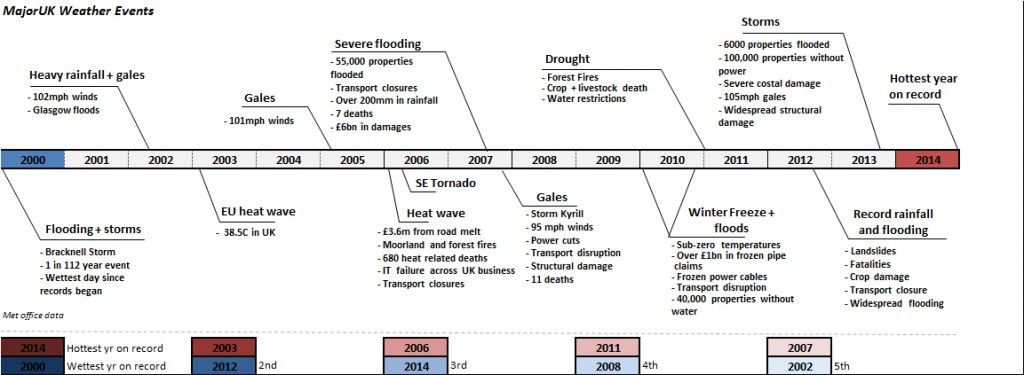

As the graphic below shows, the UK has experienced a remarkable succession of extreme weather events since 2000, including the wettest and hottest five years on record. While these events cannot themselves prove the existence of a trend, they have certainly ignited a feeling in the public consciousness that we are living in a world of increasing weather volatility and extremes.

Major UK weather events

Why does mitigating climate change matter to UK insurers? The easiest answer to this question is that insurers – especially property insurers – are affected by it. More extreme weather events, and increasing uncertainty about climate risks, mean more claims, more volatility and in the worst cases insurability problems for consumers desperate to protect their homes and livelihoods.

There is a more positive answer. Both as assumers of risk, and as investors, insurers have an opportunity to help shape and enable the transition to a low carbon world. Through insurance, financial risks relating to renewable energy generation, low carbon vehicles and energy efficient homes are managed, and it is vital that insurers continue to develop the risk management solutions that enable future waves of low carbon technology to blossom. As investors in the low carbon economy, insurance companies have huge transformational potential, as long as structures are embedded that deliver the returns on investment that these firms need.

The insurance industry can already be proud of the work it does in these areas, but there is much more to do - within the sector and working with Government - if the good outcome we hope to achieve in Paris is to be realised on the ground.

Matt Cullen is Assistant Director, Head of Strategy at the Association of British Insurers (ABI).

Feeling the Heat? Climate Challenges and Opportunities for the Insurance Sector takes place on 24 March 2015, featuring a keynote speech by the Rt. Hon. Ed Davey, Secretary of State for the Department of Energy and Climate Change. Register your place.