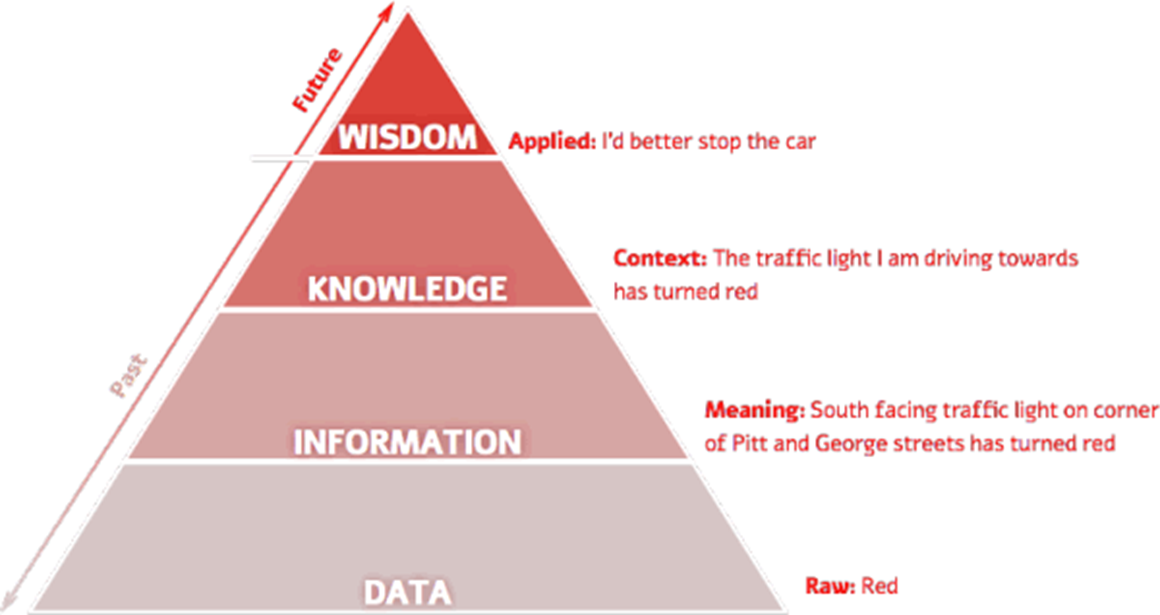

Developing the right processes and technologies to enable your company to climb up the pyramid is a key competency. The value that can be realised is clear. McKinsey identify that life insurers using social network and geographical data reduce fraud by up to 25 percent.

However, consumers are of course becoming more wary of the data captured by companies, they are starting to know more about us than even our most intimate of friends or family. As the Guardian recently reported, a user received over 800 pages from Tinder when she asked for her data to be exported and sent to her.

Moving from Risk Mitigation to Risk Avoidance

One hypothesis is that as more data is collected and acted upon the role insurers will start to evolve into one that is closely aligned with the consumer’s own needs. So rather than being a financial safety net, the job is actually helping the consumer avoid the eventually they are insuring against. By helping the consumer life a more healthy live or add sensors to their home risk is reduced and therefore premiums can come down. Great news for the consumer, but something that should start to trigger conversations about business models and future roles for those providing the insurance.

Expectations from the unreasonable consumer

Today’s consumer expectations are not set by past interactions with your brand, or even the conventions of your competitors – they are set by the very best experience they have ever had. If that’s paying with an image of their face at KFC or having all their whims catered for when they check into a hotel. This phenomenon is known as ‘transference’. We bring expectations from one company to another and expect the same level of service, no matter what the underlying technical complexity may be.

This has big implications for the insurance industry, it’s been relatively insulated from disruption until recently, regulatory environments and complexity have kept the innovations to the sales and marketing end of the business, however we’re seeing new market entrants start to change the landscape.

When it comes to the to-do list, yes you need to get your forms under control, yes you need easier to navigate policy definitions, yes you need to provide cover for your customer’s evolving needs - but these are the hygiene factors, get these right to even stay in the game.

The real winners of the next economic revolution will be the ones who manage to ride the waves of evolving consumer and technology landscape to create new products and services that differentiate and disrupt.

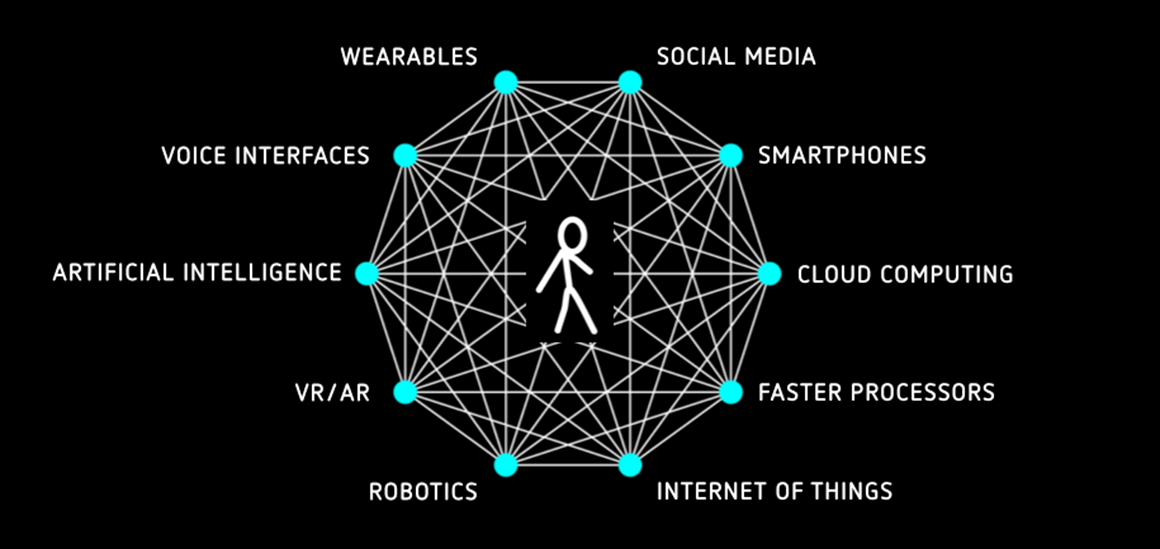

My talk, The exponential age: People, technology and progress will look at the key social, technological and commercial trends that will matter and what they might mean for the insurance industry,