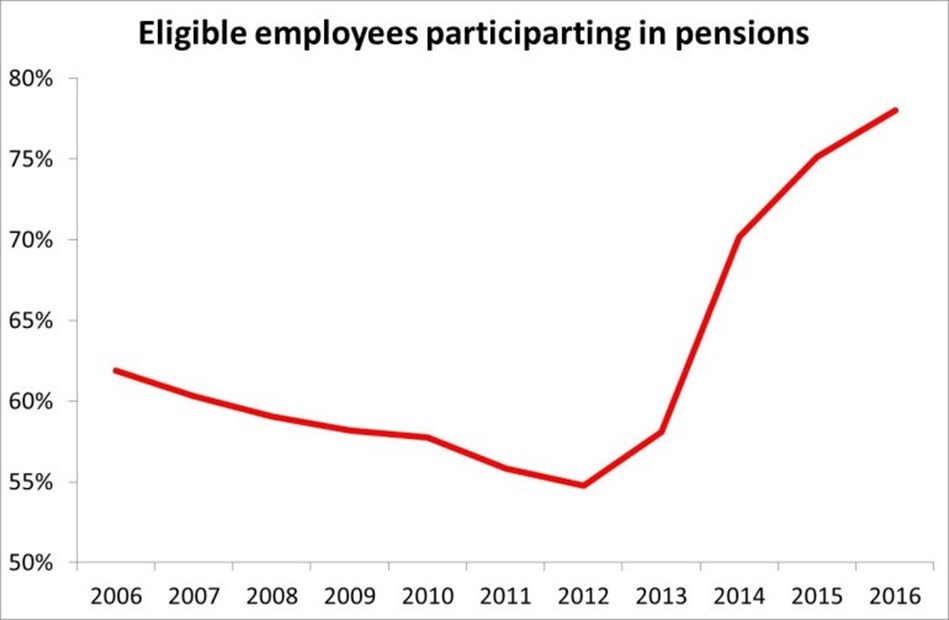

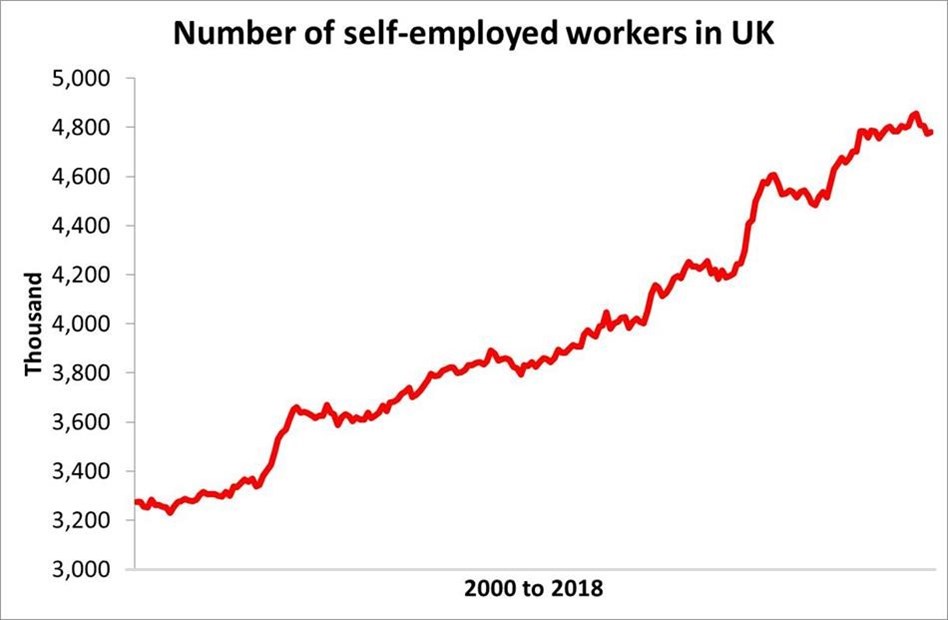

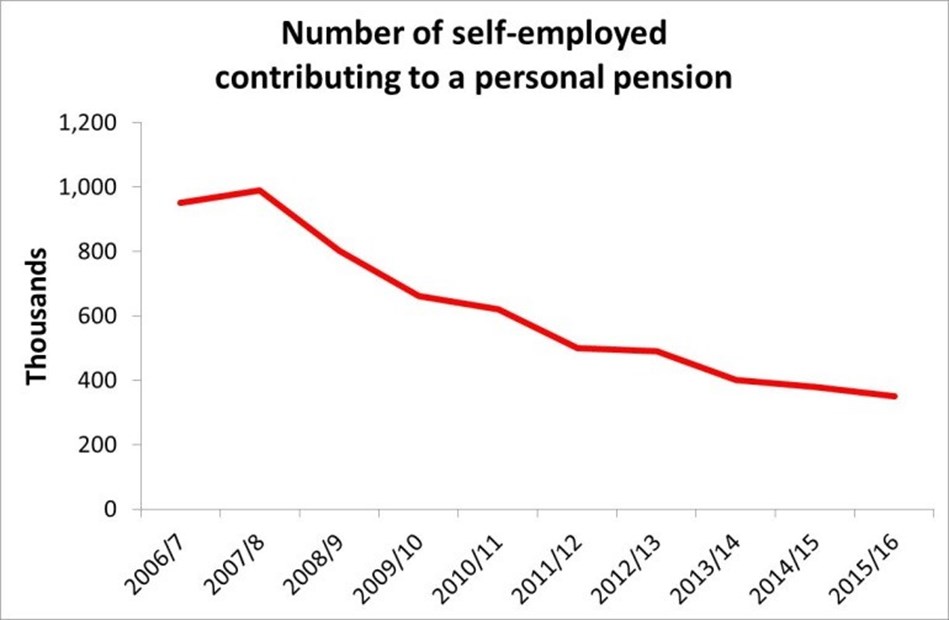

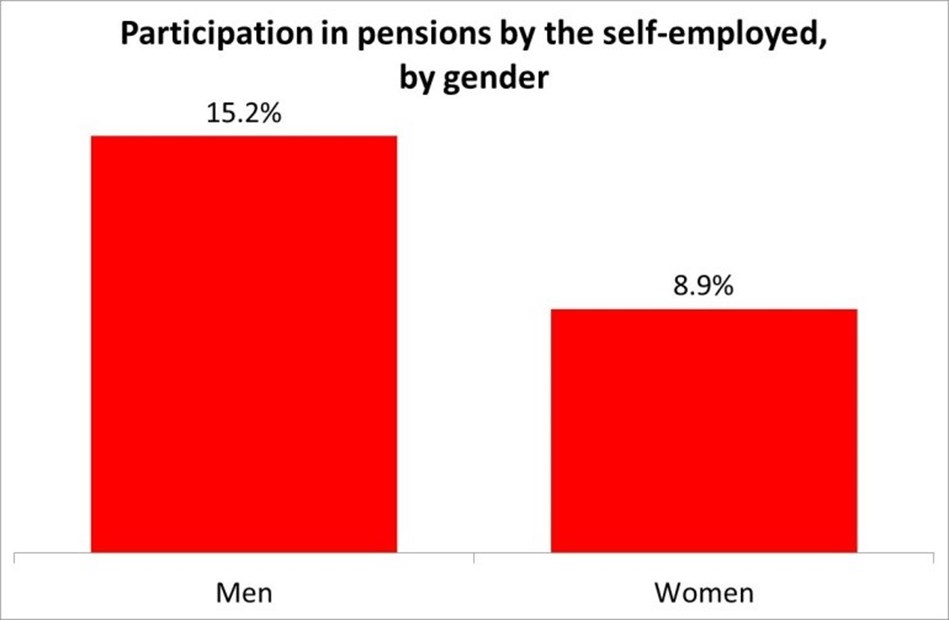

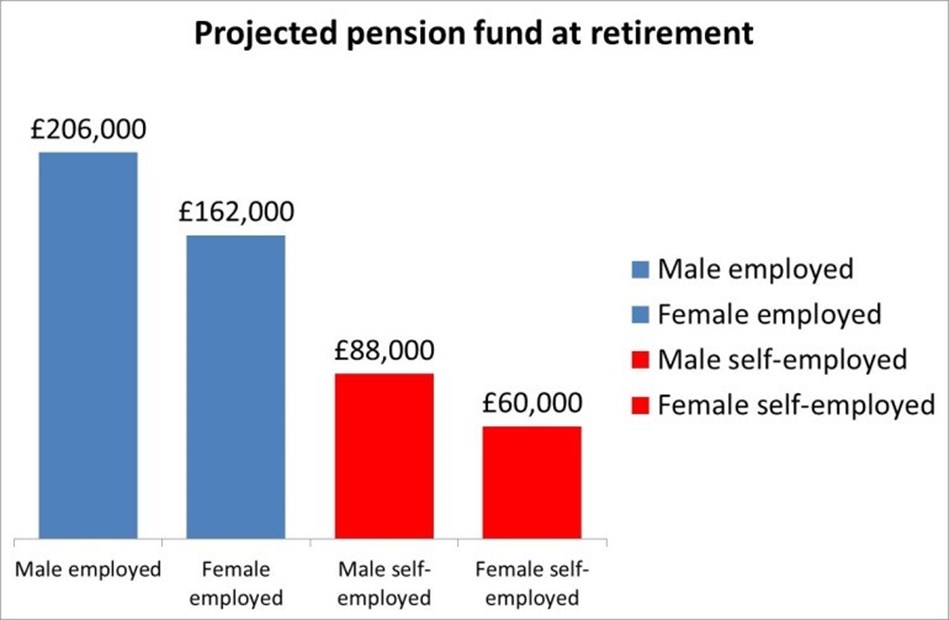

Pension participation has been revolutionised over the past 6 years. Since the introduction of automatic enrolment in 2012, participation in workplace pensions has hit an all-time high. This is a great success, but one population is being left behind – the self-employed. There is a growing army of self-employed workers in the UK, and they are currently outside the scope of auto-enrolment.

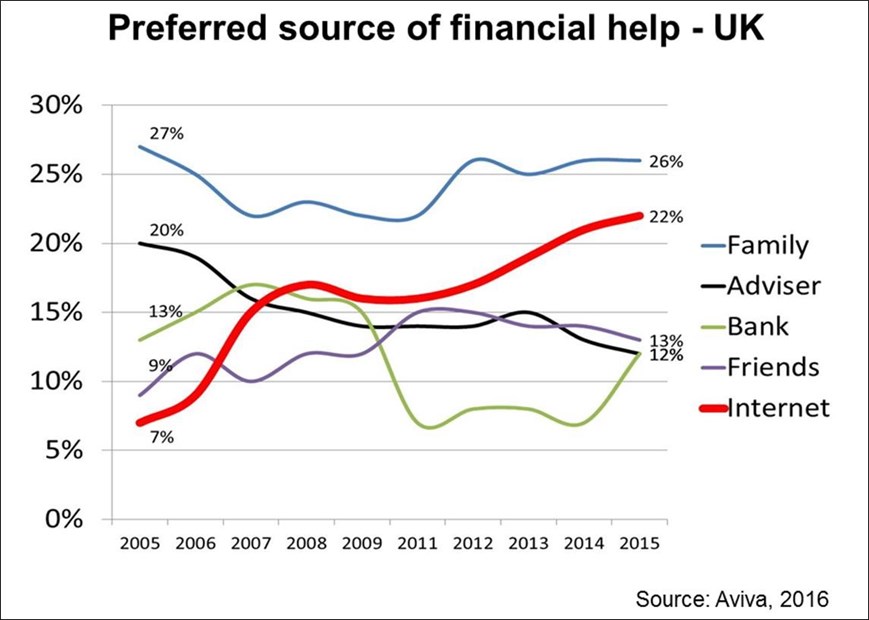

On 26 and 27 March, the Association of British Insurers, the Department for Work & Pensions, and HM Treasury will host a two day “tech-sprint” at Aviva’s Digital Garage in London[1]. This 48 hour event will challenge the best business and tech minds to identify digital solutions that could help address this growing problem.

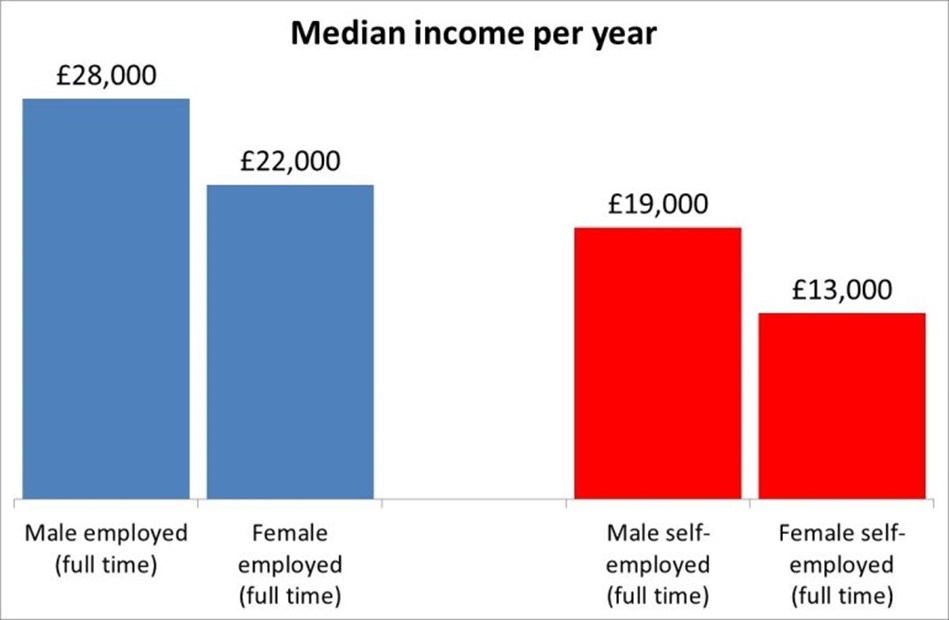

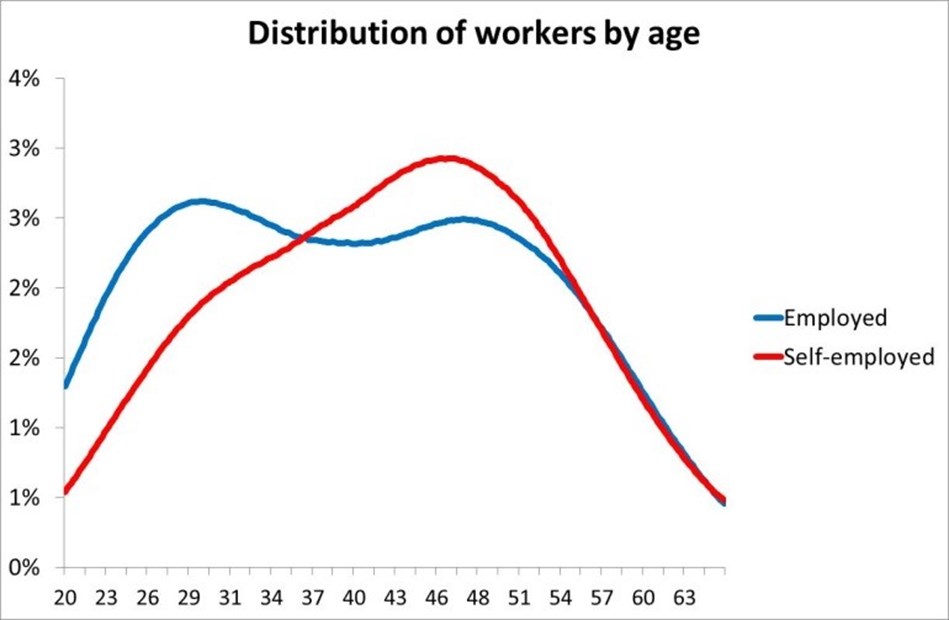

Alistair McQueen, Head of Savings & Retirement at Aviva, shares ten top facts about the self-employed, their pensions, and the potential for digital technology.