The digital insurance landscape in 2017

16/06/2017

I've spent a fair amount of time in recent weeks speaking at and chairing various digital insurance events. In preparing for these, as I've revisited my old blogs, speeches and publications on data and digital issues, I have reflected on how the environment has evolved over the last couple of years.

I've spent a fair amount of time in recent weeks speaking at and chairing various digital insurance events. In preparing for these, as I've revisited my old blogs, speeches and publications on data and digital issues, I have reflected on how the environment has evolved over the last couple of years.

The same strategic challenges remain

I wrote two years ago about the digital revolution taking place right across the insurance business model, and the three key tranches of challenges that it creates. The need for insurers to engage with these remains just as strong today:

1. Operational challenges.

Overcoming legacy systems to provide genuinely flexible and tailored offerings to customers, embedding the analytical capabilities to deal with increasingly unstructured and varied data, or making sure business culture is an enabler, not a blocker, of innovation and change.

2. Propositional challenges.

Incorporating the opportunities presented by digitisation into the propositions that our customer, and the wider world judge us on. This doesn’t just mean insurance products themselves (although they will certainly evolve considerably), but also the way we present those products and the routes through which we sell them.

3. Acceptability Challenges.

Understanding and meeting not just the expectations of our customers, but also the expectations and worries of the broader environment in which we operate – whether that’s a media and politicians who have limited trust in our sector, or the regulators who set the parameters we work within.

New buzzwords

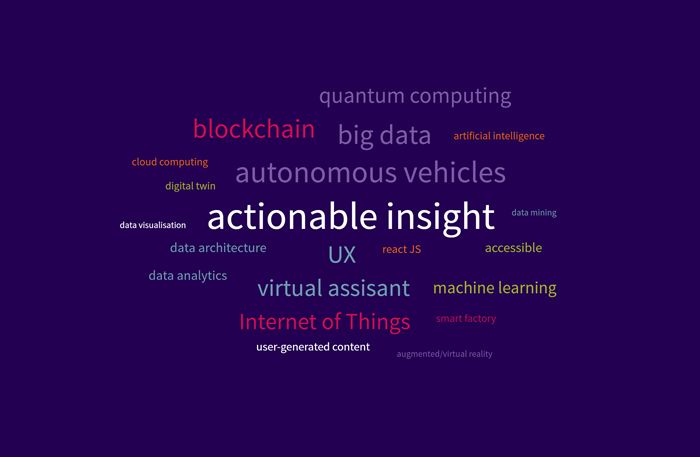

Some of the buzzwords and phrases we know and love ('actionable insight' is my favourite) just won't go away, but we've also seen terms that were sexy on the conference circuit a year ago fade into the normality of 'business as usual' today. 'Big data' is certainly in this camp now - such an embedded concept in insurers’ digital thinking that we barely feel the need to talk about it anymore. Even Blockchain is starting to feel part of the furniture, albeit not furniture that we are fully on top of yet!

As these buzzwords start to fade, others swoop in to take their place. Aligning with broader tech trends, AI and machine learning are the front-runners here, with insurers scrambling to understand how they will revolutionise operational efficiencies and customer insights.

A more nuanced perspective on disruption

Finally, it’s not just the established market looking to rise to digital challenges. Compared to two years ago, the industry is now bursting at the seams with tech start-ups looking to rip up the old playbook, changing the way the insurance sector works, and how it serves its customers.

There is certainly a more nuanced perspective on this ‘external disruption’ though, compared to 18 months ago. Back then, most of the talk centred on an antagonistic set of processes; the tech firms – from Google to small start-ups – usurping the lumbering incumbents. Now we hear much more talk (and evidence) of partnership and symbiosis between existing insurers and InsureTech firms, reflecting both the realisation from insurers that they often need help being innovative, and from InsureTech firms that partnering with incumbents is the easiest way to get to market at scale in a highly regulated sector. This is a positive state of affairs that I expect to see create real value in 2017.

So now as I prepare the programme for the ABI’s own digital, data and cyber conference on October 19th (get your tickets here!), I just need to work out how to fit all of this stuff in!