- Latest hike in Insurance Premium Tax (IPT) could add an extra £47 to the average annual household bill.

- Rise will be felt the hardest by those paying higher premiums, including young drivers and those with private medical insurance.

- With IPT having doubled in under two years, ABI calls for a freeze on this raid on the responsible.

Hard-pressed households face a further squeeze on their family budgets when the latest increase in the government’s Insurance Premium Tax (IPT) to 12% comes into effect on 1 June, only eight months after it rose to 10%. The tax is payable on most general insurance policies including home, motor, pet, private medical insurance, and cash plans taken out by individuals, as well as commercial insurance taken out by businesses.

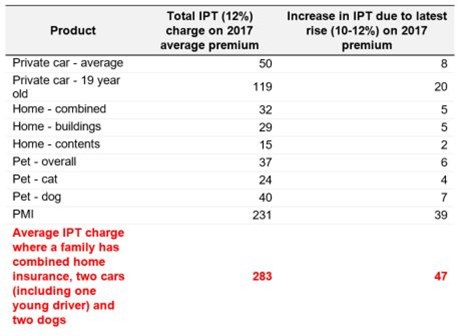

This latest increase could add an extra £47 to the average household’s annual general insurance bill. Overall, the current rate of IPT at 12% could now be adding an extra £283 a year to a typical household’s annual insurance bill as the rate has now doubled since November 2015. This latest hike will mean that the Government will rake in £5.8 billion a year from IPT.

This latest rise comes at the worst possible time, with average premiums rising due changes to how personal injury compensation is calculated, rising repair bills, and a resurgence in whiplash-style claims.

Insurance customers who pay higher premiums will be worst hit. For example:

- Young and older drivers who tend to pay more for motor insurance. A typical 19 year old driver for example could see their annual motor premium increase by £20 following this latest rise.

- Those with private medical insurance and cash plans could face an extra £39 a year on their premium.

- Businesses will also be hit – the 12% rate could add an extra £300 in commercial insurance premiums

How IPT is contributing to higher premiums:

James Dalton, Director of General Insurance Policy at the ABI, said:

“With a doubling of IPT in just under two years it is time to call a halt to this raid on the responsible. This tax penalises hard working families, as well as businesses, who have done the right thing by taking out insurance to protect against many of life’s uncertainties. This latest hike must be the last. The next government must freeze this tax, to give hard working households and businesses a break.”

-Ends-

Notes for Editors

1. Enquiries to:

Malcolm Tarling 020 7216 7410 Mobile: 07776 147667

Lauren Gow 020 7216 7327 Mobile: 07889 641702

Sarah Cordey 020 7216 7375 Mobile: 07860 189071

Insurance Premium Tax was first introduced to the UK in 1994.

- From 1 October 1994, a single rate of 2.5% was charged

- 1 April 1997: increased to 4%

- 1 July 1999: increased to 5%

- 4 January 2011: increased to 6%

- 1 November 2015: increased to 9.5%

- 1 October 2016: increased to 10%

- 1 June 2017: increased to 12%

The Government exempts the following products from IPT:

- Life insurance

- Mortgage insurance

- Insurance for spacecraft

- Commercial ships and aircraft

- International railway rolling stock

- Lifeboats and lifeboat equipment

- Goods in international transit

2. The Association of British Insurers is the leading trade association for insurers and providers of long term savings. Our 250 members include most household names and specialist providers who contribute £12bn in taxes and manage investments of £1.6 trillion.

3. An ISDN line is available for broadcast

4. More news and information from the ABI is available on our web site, www.abi.org.uk.