Almost 100 representatives from the pensions industry, fintech firms, banking, regulation and Government have collaborated with modern businesses such as Hermes and Uber to create a range of ideas to help the self-employed save for retirement.

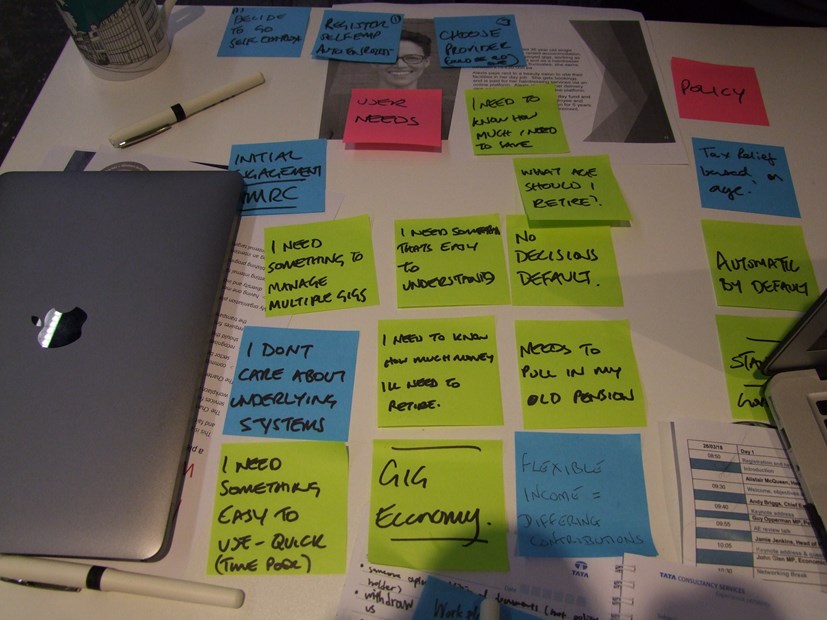

During a two day Tech Sprint (March 26th and 27th) hosted by the Association of British Insurers (ABI), Department for Work and Pensions and HM Treasury, teams looked at how technology could be used to make it easier for those who work for themselves to build up long-term savings.

Nearly 5 million people across Britain are self-employed but fewer than 1 in 5 is saving into a personal pension. This leaves many thousands of workers potentially facing problems financing their retirement.

The event drew to a close with teams being recognised for their achievements in four categories, and an overall winner was also announced.

- Overall winners, team 5, included contributors from Bravura, Tata Consultancy Services, Trezeo and Prudential. They proposed using open banking to smooth out irregularities in self-employment income, while ear-marking funds for both a rainy day savings fund and for long-term savings.

- Recognition for both innovation and simplicity went to team 9. Participants from NEST, Parmenion, SalaryFinance, Trezeo and the PLSA proposed an app called SERGE that would plug into platforms such as Uber, Facebook and YouTube to help workers such as Uber drivers put money aside as they do particular jobs.

- The consumer focus title went to team 3, from Hermes and LV=, for their work on an interactive pensions dashboard with an emphasis on empowering people by giving them complete control over what money went where, and would show them how it was accumulating.

- Given the award for impact, since their idea was judged to have the potential to make the most difference to a worker’s life, was team 1. They suggested a new app, called Giggle, which would allow someone working for a number of gig employers to channel pension contributions through a single platform. They had team members from Moneysavingexpert.com, NEST, Prudential, Uber and the CBW Group.

The judges were Michelle Cracknell of the Pensions Advisory Service, Will Lovegrove of PensionSync and Chris Curry of the Pensions Policy Institute.