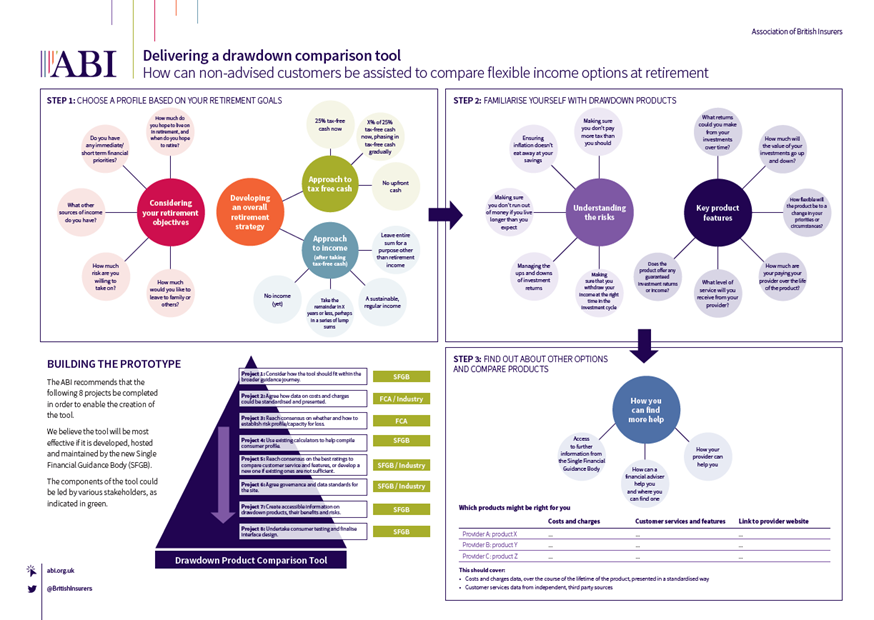

The Association of British Insurers (ABI) has today outlined the steps required to create a drawdown comparison tool. To bring the tool to fruition, the ABI believes joint action is required from the pensions industry and the FCA, whilst responsibility for making the tool available should sit with the new Single Financial Guidance Body (SFGB).

A key component of the tool is the need for some form of standardised presentation of costs and charges data. This will require an agreement about the appropriate assumptions or scenarios that could be used to enable a simple, but meaningful comparison of products - boosting transparency and maximising consumers’ ability to pick the most suitable alternative.

While advisers already make recommendations based on a comparison, non-advised customers will find it harder to compare products themselves, either before or while they are in drawdown.

Another key element of the proposals is the development of ‘consumer profiles’, based on risk and retirement strategies, that will provide relatable scenarios for customers to align themselves with to make a more personalised decision about the retirement journey.

“The pension freedoms have thrown up a vast set of new retirement options, and consumers need more help to understand their options and compare between them. This is not just a one-off decision, but needs to be based on their overall goals for retirement.

“The pension freedoms have thrown up a vast set of new retirement options, and consumers need more help to understand their options and compare between them. This is not just a one-off decision, but needs to be based on their overall goals for retirement.