- Insurers pay out £13.9m per day in income protection, critical illness cover and life assurance

- 97.8% of claims made across group and individual protection are paid

- £340 million increase year-on-year

New figures released by the Association of British Insurers (ABI) and Group Risk Development (GRiD) show that the insurance industry paid out a record £5 billion in protection claims in 2017 – representing an increase of more than £340 million year-on-year.

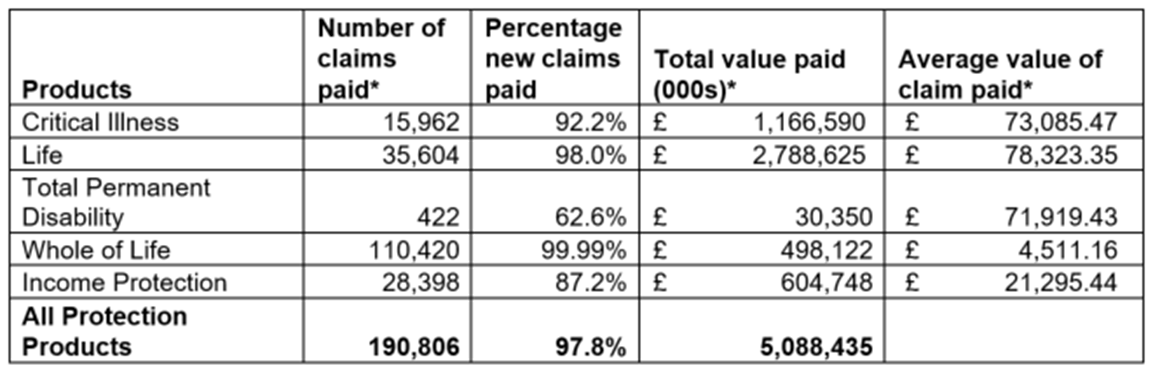

Overall, virtually all protection insurance claims (97.8%) were paid in 2017.

Protection insurers paid out nearly £14 million every day through products such as income protection, critical illness or life insurance. These products are vital to helping people to get back on their feet following an injury, illness or bereavement.

In individual protection, the number of claims paid increased by more than 20,000 year-on-year. The total value of claims paid for critical illness passed £1 billion for the first time ever, with the average claim increasing to £73,000. Also, 96% of critical illness claims made for cancer were paid out, demonstrating the positive impact these products have at the most difficult of times.

In group protection, as well as supporting a record number of families with a financial payment, group risk insurers helped nearly 5,000 people back to work after a period of sick leave and a further 7,900 were assisted by the industry during 2017 through referrals to help and support, funded by group risk insurers. Cancer was a main cause of claim across all three group risk products and mental illness was marginally the top cause of claim under group income protection policies.

Roshani Hewa, Assistant Director, Head of Health and Protection at the ABI, says:

“Protection products provide vital financial support in people’s time of need. To see that the industry has collectively supported families with more than £5 billion in 2017 for the first time ever is incredibly positive.

“A serious injury or illness can be traumatic, but with insurers paying out on more than 97% of claims, consumers can rest assured that they’ll have the support they need if the worst happens.”