- Motherhood key driver behind lack of women in top roles

- Make more senior jobs available part-time or as job shares, research proposes

- More evidence of ‘what works’ needed to tackle disparity

New independent report details ways of tackling gender seniority gap

21/09/2018

A new independent report published today outlines the scale of the challenge facing women trying to reach top roles. Tackling the gender seniority gap: what works for the insurance and long-term savings industry, commissioned by the ABI from research consultancy Public First, takes a comprehensive look at barriers to women getting top jobs. Evidence for the report is drawn from both inside and outside the insurance industry. Key findings include:

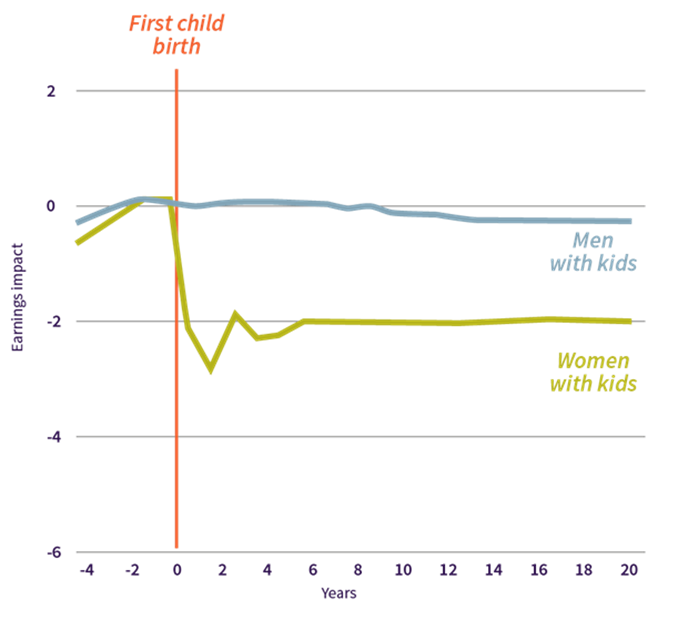

- The single biggest reason for the seniority gap is working patterns associated with motherhood.

- To reduce the seniority gap substantially, it needs to be easier for part-time or formerly part-time employees to advance. Options to do this include making more senior jobs explicitly available part-time, making job-shares easier and more attractive and allowing more rapid advancement opportunities for women who worked part-time once they come back to full-time work.

- Sexism is best tackled by organisational redesign, not training. Ways of doing this include better use of interviews to make them more structured and ability-based, not free-form.

- Research on the impact of training to ‘remove’ bias is unconvincing. There is a lack of evidence that anti-bias training results in a systemic increase in promotion, or a reduction in the gender gap.

- The insurance and long-term savings industry has put in place a very large number of interventions, as have other sectors. But there is little correlation between the interventions that companies are using and what can demonstrably be shown to be working.

ABI Chair Amanda Blanc said:

“This report shows that mothers still face a huge challenge to make progress in their career when they return to work. We want to speed that up and the evidence shows that tackling the ‘motherhood penalty’ may be the best way to do this.

“While I have no doubt that many of the people at the top of the industry are fully committed to change, it is simply not good enough that in 2018 there are 60% fewer women at board level than entry level.

“To change this we need to focus on what interventions work, not what makes us feel like we are trying. Only then will we start to see the seniority gap close.”

The report outlines a series of recommendations for the industry and the ABI and can be found here.

Director General of the ABI Huw Evans said:

“The ABI commissioned this report following a roundtable with our member company CEOs. They were interested in the answers to two questions; what practical steps will help get more women into senior roles and what interventions make the biggest difference?

“There is a lot in this research to engage with and I am grateful to Public First for their thorough analysis. We have plenty to consider here and will be working through the recommendations with members before deciding on the next steps. Our future as a successful and thriving industry depends in no small measure on getting this right. “

Public First Founding Partner Rachel Wolf said:

"We know that big companies like insurance firms want to make sure that women rise as high as ability can take them. Our research found that the biggest barrier for women was becoming a parent. So it makes sense that this is what big firms should target first. If companies can take real steps to make it easier for parents to combine having children with pushing on in their career, then that could be a way of generating really positive results for women in a sustainable way."

-ENDS-

Notes for Editors

Enquiries to:

Malcolm Tarling

020 7216 7410 Mobile: 07776 147667

Sarah Cordey

020 7216 7375 Mobile: 07860 189071

Dominic Stannard

020 7216 7350 Mobile: 07725 245838

1. The Association of British Insurers is the voice of the UK’s world leading insurance and long-term savings industry.

A productive, inclusive and thriving sector, we are an industry that provides peace of mind to households and businesses across the UK and powers the growth of local and regional economies by enabling trade, risk taking, investment and innovation.

2. An ISDN line is available for broadcast

3. More news and information from the ABI is available on our web site, www.abi.org.uk.