Amanda Blanc, Chair of the ABI and CEO EMEA for Zurich Insurance Group, said:

“The vast majority of adults in this country are customers of the insurance and long-term savings industry in some way. Matching the diversity of our workforce to the diversity of the communities we serve is essential to our industry’s future success. Such a change takes time, but the last few years have seen a real shift in commitment at the highest levels of the industry, and at last there are signs the dial is starting to shift.

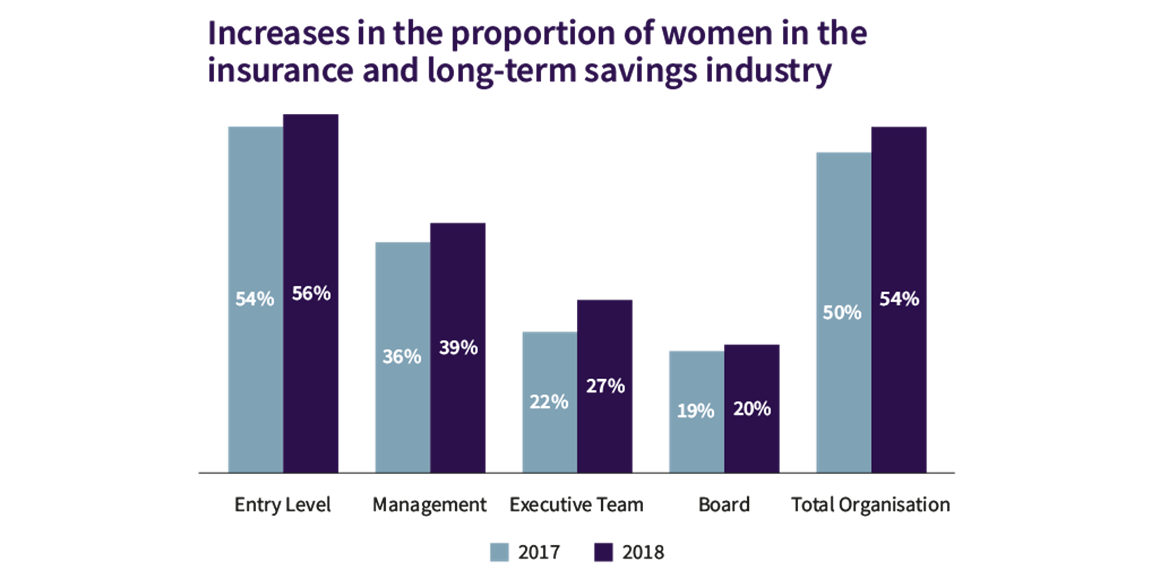

“Gender equality is only one aspect of diversity but I am encouraged to see growth in female representation at manager and executive levels, and more women than men continue to join the industry. This progress needs to be repeated, year after year, if the industry is to become truly diverse. And where we make progress on gender, we must scrutinise what is working and why so we can improve diversity across the board – on sexuality, on ethnicity and more.”

Huw Evans, Director General of the ABI, said:

“Improving diversity and inclusion in the insurance industry is a key priority for the leadership of the sector. To make meaningful progress, firms first need to know where they stand. Our survey was established as a practical tool to support our members on this issue and to see so many more involved this time round is an endorsement of our approach. Let’s hope these early signs of progress on gender equality are just the start.

“Insurers know that becoming a fully diverse and inclusive industry requires firms to have a strategy and to make changes – simply having positive intentions won’t wash. Our diversity and inclusion network goes from strength to strength and our Future Leaders programme has more women on it than men for the first time. We remain committed to providing the practical assistance our industry needs to achieve genuine change.”

As well as the ABI’s annual survey of diversity in the industry, the association last autumn also published an independent report into ways of tackling the gender seniority gap, and has recently contributed to a government consultation on ethnicity pay reporting.

-ENDS-

Notes for Editors

1. The percentages are calculated based on the companies that were able to respond to the relevant questions; this means not all values may be calculated on the same basis.

2. The gender representation data is based on aggregated company data, it is not an average across participating companies.

3. Increases in the participation of companies in the data collection means that statistics from 2018 may not be calculated on the same basis as those from 2017.

4. Some of the statistics for 2017 may have changed from the values published last year, this is due to improved processing and corrections to the data submitted.

Enquiries to:

Malcolm Tarling 020 7216 7410 Mobile: 07776 147667

Sarah Cordey 020 7216 7375 Mobile: 07860 189071

Dominic Stannard 020 7216 7350 Mobile: 07725 245838

- The Association of British Insurers is the voice of the UK’s world leading insurance and long-term savings industry.

A productive, inclusive and thriving sector, we are an industry that provides peace of mind to households and businesses across the UK and powers the growth of local and regional economies by enabling trade, risk taking, investment and innovation.

- An ISDN line is available for broadcast

- More news and information from the ABI is available on our web site, www.abi.org.uk.