Fraudsters caught out by the City of London Police’s Insurance Fraud Enforcement Department (IFED), included:

- No escape for escape of water claimant. A serial fraudster was jailed for more than 3 years after he lied about his poor claims history to secure insurance against which he made a series of claims for theft, burglary and damage to property, including numerous escape of water claims. He was also dismissed from his employment at a claims management company for diverting £18,000 to his own bank account and attempting to divert a further £17,000.

- Road to jail. A man described by the judge as ‘profoundly dishonest’ was jailed for 2.5 years for making a fraudulent claim – including for pre-existing damage - following a road accident in which he used documentation that had been tampered with.

- No one is above the law. A police officer was convicted for a motor fraud valued at £10,000 after he was incriminated by his own dashcam footage which showed that debris from a passing van that was alleged to have caused him personal injury and damage to his car turned out to be polystyrene.

- Phantom passengers. A couple were convicted after they worked together to make a series of claims, with a potential £50,000 loss to the insurers involved, for personal injury and damage to vehicles from accidents that never happened. They also created ‘phantom’ passengers to try to claim more money.

- Pet shop ploy. A man was convicted after he was caught on CCTV staging ‘slip and trips’ at a pet shop and a discount store which would have netted him £11,000

- Caught by camera. A man was sentenced after CCTV caught him purposely banging his knee several times on a paving stone to make a fake injury claim. On spotting the camera, he started to hop on one leg to authenticate the injury. He claimed that the footage had been misinterpreted and that he was testing the paving stones to prevent injury to others.

- Ghost in the City. A man was arrested for acting as a ‘ghost broker’ selling fraudulent car insurance, including to NHS workers.

Further details of these cases, and other examples of insurance frauds uncovered, can be found on the IFED Website here and here.

Key findings from ABI’s survey of members highlights that last year:

- There were 107,000 detected fraudulent claims, up 5% on 2018. The rise was mainly due to increases in motor and property scams.

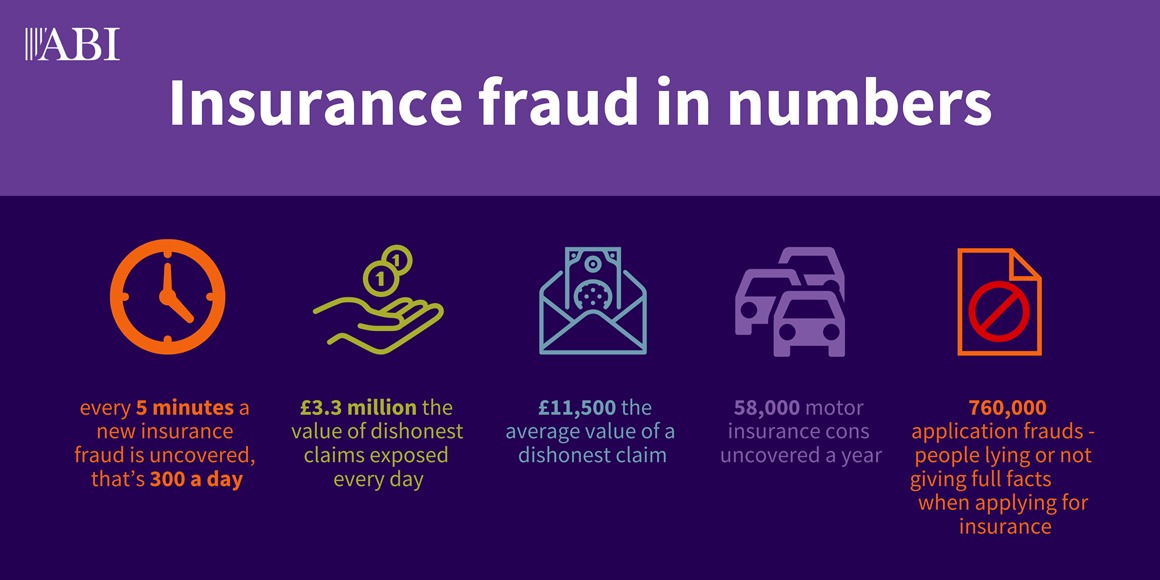

- While the volume increased, there has been a small decrease of 2% in the value of detected claims fraud to £1.2billion – the equivalent of £ 3.3m uncovered every day. This resulted in a decrease in the average value of a fraudulent claim to £11,400, compared to £12,200 in 2018.

- Motor insurance frauds remained the most common, up 6% in number to 58,000 on 2018, albeit their value, at £605 million, fell slightly. Around 75% of fraudulent motor claims contain a personal injury element – this may reflect some fraudulent activity ahead of the introduction of personal injury reforms in April next year

- Property frauds showed a significant increase. There were 27,000 dishonest claims detected worth £124million – a rise of 30% in number and 8% in value on 2018.

- The number of liability frauds fell by 14% to 19,000. This may reflect insurers clamping down on ‘trip and slip’ and noise induced hearing loss claims, as well as measures implemented by the travel sector and government to reduce dishonest gastric illness holiday claims

- Improved prevention measures and better reporting reflected a significant increase in the volume of application fraud detected, up over 200% on the previous year to 760,000 cases, worth £1.4billion. Application fraud typically includes non-disclosure of previous claims.

Mark Allen, ABI’s Manager, Fraud and Financial Crime, said:

The industry makes no apology for its relentless pursuit of insurance cheats, to protect genuine customers, who end up footing the bill through their insurance premiums. Insurers will not hesitate to ensure that fraudsters seeking to profit at the misery and expense of others will suffer severe and long-lasting consequences.

Insurers know that the Coronavirus crisis has led to financial hardship for some, and with scammers always preying on people’s anxieties, now it is especially important for consumers to be on their guard, for scams like being approached by someone offering cheap motor insurance. The golden rule is never act in haste – if a deal is too good to be true, then it probably is.”

Detective Superintendent Peter Ratcliffe, Head of the City of London Police’s Economic Crime Funded Units, said:

Insurance fraud is not a victimless crime and the effect of dishonest claims are felt by everyone. As well as bogus insurance claims inevitably increasing premiums for honest customers, certain tactics used by fraudsters, such as ‘crash for cash’, put the lives of innocent members of the public at serious risk.

Despite these encouraging figures, which show that IFED and the insurance industry are working well to combat insurance fraud, it’s vital that we don’t ease up on our efforts. The fight against insurance fraud is an ongoing one, so we need to continue working together to prevent and detect this crime type, and ultimately bring the criminals involved to justice.”

Ben Fletcher, Director of the Insurance Fraud Bureau, said:

ABI’s latest figures help to draw attention to the clear challenges we are facing in the fight against insurance fraud.

Insurance fraud is not a victimless crime, because fraudsters who carry out dangerous scams like ‘Crash for Cash’ and who deliberately damage property put lives at risk. These statistics show the problem remains significant and the sad reality is that the frequency of these scams normally only increases in times of recession and financial hardship.

By the public reporting evidence of insurance fraud to the IFB’s Cheatline, we are able to work with insurers and the police to take action. We’ll be campaigning in the months ahead to encourage more people to step forward and report insurance fraud."

-ENDS-

For further information:

Malcolm Tarling 020 7216 7410 Mobile: 07776 147667

Laura Dawson 020 7216 7338 Mobile: 0772 5245838

Sarah Aspinall 020 7216 7412 Mobile: 0772 5245297

The Insurance Fraud Enforcement Department (IFED) is a specialist police unit dedicated to tackling insurance fraud. Established in 2012, IFED is funded by Association of British Insurers (ABI) and Lloyds of London members, and is hosted by the City of London Police within the Economic Crime Directorate. IFED's team of detectives, financial investigators and police staff act with operational independence while working closely with the insurance industry.

For further details on the cases mentioned above, contact the City of London Police press office: [email protected]

The Insurance Fraud Bureau (IFB) is a not-for-profit company establish in 2006 to lead the industry’s collective fight against insurance fraud. They act as a central hub for sharing insurance fraud data and intelligence, using their unique position at the heart of the industry and unrivalled access to data to detect and disrupt organised fraud networks.

For media enquiries please contact [email protected]

The Association of British Insurers is the voice of the UK’s world leading insurance and long-term savings industry.

A productive, inclusive and thriving sector, we are an industry that provides peace of mind to households and businesses across the UK and powers the growth of local and regional economies by enabling trade, risk taking, investment and innovation.

Skype and FaceTime are available for broadcast

More news and information from the ABI is available on our web site, abi.org.uk.