- The average cost of motor insurance drops to its lowest in five years

- £38 fall in the average price of motor insurance in the first half of this year, as drivers benefit from any costs savings made by insurers during the pandemic lockdowns.

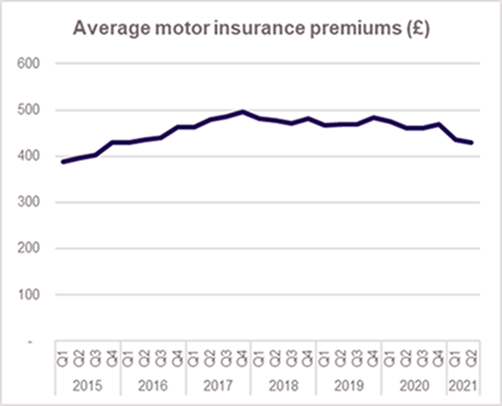

The average price motorists are paying for their motor insurance now stands at a five year low according to the ABI’s latest Motor Insurance Premium Tracker, published today. The Tracker is the only market survey that looks at the price consumers pay for their cover, rather than the price they are quoted.

The ABI’s latest Tracker for the second quarter highlights that:

- The average price paid for comprehensive motor insurance in the second quarter of this year was £430. This was down £6 on the previous quarter, falling by £30 (7%) over the last year, since the same quarter, 2020.

- The current average motor insurance premium of £430 stands at its lowest in just over five years, since quarter one, 2016.

- Over the first six months of this year the average motor premium has fallen by £38 since quarter four last year.

The fall in part reflects insurers passing on cost savings from fewer claims settled during previous national lockdowns, with fewer vehicles on the roads. It comes despite the continued cost pressures for insurers of rising repair bills.

Laura Hughes, ABI’s Manager, General Insurance, said:

“The fall in the average motor premium clearly shows that millions of drivers continue to benefit from cost savings made by insurers during the lockdowns. It will be interesting to see if there is a rise in motor claims as we emerge from the pandemic and road traffic continues to increase.

“The fall in the average motor premium clearly shows that millions of drivers continue to benefit from cost savings made by insurers during the lockdowns. It will be interesting to see if there is a rise in motor claims as we emerge from the pandemic and road traffic continues to increase.

“We will also be watching closely the impact of the Official Injury Claims portal launched in May which will simplify the whiplash claims process, while ensuring proportionate compensation for genuine claimants.

“And while underlying cost pressures around rising repair bills will remain, the market will stay competitive, enabling motorists to shop around for the best deal for their needs.”

For more information contact the Press Office.