Articles

-

Read our Response to the Autumn Statement 2023

22/11/2023

We respond to the Autumn Statement delivered by the Chancellor of the Exchequer.

-

Government hopes for CDC pension schemes based on incomplete picture

12/09/2023

We warn that Government predictions for Collective Defined Contribution (CDC) pensions give an incomplete picture of potential returns, given the diversity across members and the financial conditions they experience.

-

Extreme caution urged with changes to Defined Benefit pensions

06/09/2023

Ahead of an appearance in front of the Work and Pensions Select Committee today, we warned that the Government should “exercise extreme caution” with fundamental changes to the DB pension system.

-

Annuity sales surge after turbulent 2022

28/05/2023

Sales of annuities surged 22% during the first three months of 2023

-

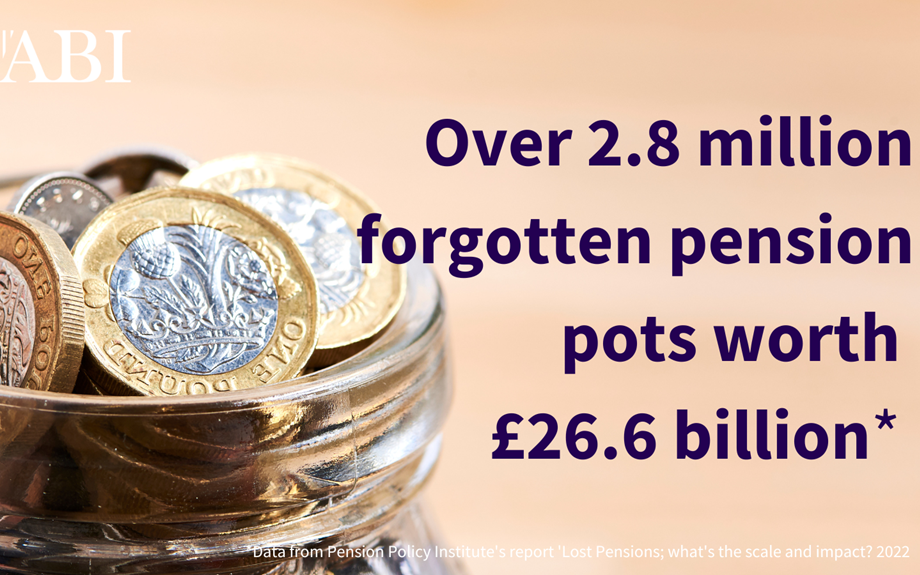

Call on UK retirement savers to take action on £26.6bn in lost pensions

27/10/2022

The Pensions Policy Institute is today publishing Briefing Note 134: Lost Pensions; what’s the scale and impact? 2022. This Briefing Note, sponsored by the Association of British Insurers (ABI) and Punter Southall Aspire (PS Aspire), shows the scale of the problem of lost pension pots has increased by £7 billion in just four years.

-

Industry identifies solutions to the growing issue of small pots

23/06/2022

An industry group, jointly convened by the Association of British Insurers (ABI) and the Pensions and Lifetime Savings Association (PLSA), has explored various solutions to tackle the issue of small deferred pension pots in the automatic enrolment (AE) workplace pension market, and narrowed them down to three options.

-

Automatic enrolment action plan needed for the next decade

21/06/2022

Marking 10 years since the dawn of automatic enrolment, the Association of British Insurers (ABI) is calling on the Government to set out how pension contributions can be increased and the eligibility criteria widened to encourage people to save more over the next 10 years.

-

Pensions campaigns combine to boost engagement

14/06/2022

Momentum is building behind the first ever Pensions Engagement Season as the cross-industry group joins forces with this year’s Pensions Awareness Week, as part of the biggest ever drive to…