Love Your Pension

A pension is simply a type of savings account. Unlike day-to-day savings, a pension is specifically for you to use when you stop working and is usually locked away until then. Money that’s in a pension is invested to try to make it grow until it’s needed.

It is now the law that almost everyone who’s employed has to have a pension set up for them by their employer. This is called auto-enrolment, so you may already be saving into a pension but not have noticed.

So…why should you Love Your Pension?

1. It's YOUR money!

Every penny of your pension belongs to you - not the Government, your employer or the pension company. It's protected and could be the most valuable thing you ever own.

2. Small change = big difference

3. When you save - your employer tops it up

Employers are required to add at least an extra 2% of your salary to your pot, out of their own pocket, and many add even more.

4. The Government tops it up too

The Government increases the amount you put away by at least 20% by not charging any tax on the money you save. It only costs you £10 to save £12.50.

5. It's worth waiting for...

You can't touch it till you're 55, but you can then access 25% of it completely tax free - or continue to let your savings grow.

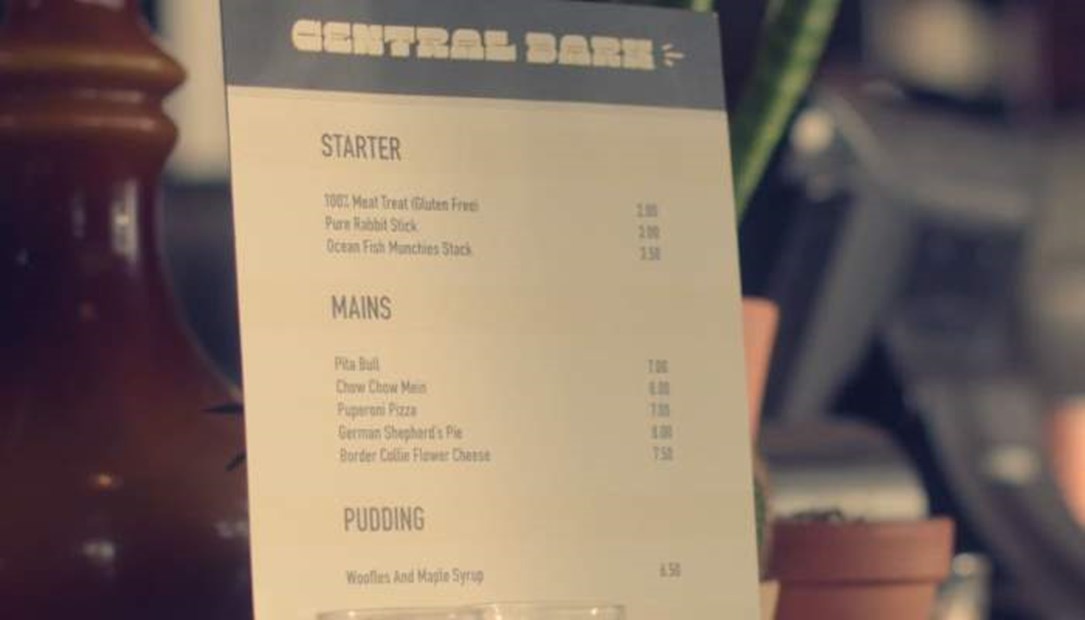

After all, you don't want to work like a dog all your life!

But what about the state pension?

Most people who retire get some state pension, providing you’ve made enough National Insurance contributions while you’ve been working. The full State Pension at the moment pays £164.35 a week – equivalent to an annual salary of just £8,546. This means most people want to have another form of income when they stop working, depending on the sort of lifestyle they have in mind.

These days there are loads of retirement options…

Since the Government introduced pension flexibilities in 2015, you now have lots of choices about what you do with your pension when you retire. You can take some as cash (watch out for the tax!), buy an income for life, buy an investment product, or a combination of all of these. If you’d like to find out more about these options, read on here.