New analysis shows impact of temperature rises on insurance claims for wind storms

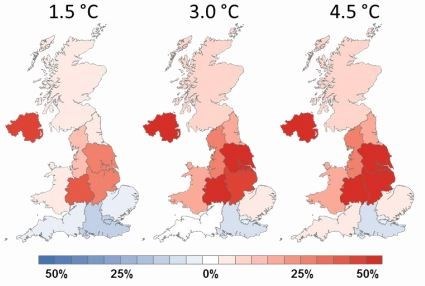

Predicted change in regional average annual losses from wind storms

The impact of climate change on the UK is likely to mean a higher number of more expensive wind storms, the insurance industry warns today.

New analysis done for the Association of British Insurers (ABI) by AIR Worldwide shows temperature increases of just a small number of degrees are likely to lead to insurance losses for high winds which could be 11%, 23% or even 25% higher nationwide. These temperature changes fall within the long-term projections of what climate change experts expect to happen.

These increased losses are not spread evenly across the country but are likely to be concentrated in Northern Ireland, northern England and the Midlands, with Southern England potentially seeing decreasing losses from storms.

This is based on Met Office analysis which shows that even small increases in temperature are likely to shift stronger winds further north.

|

Temperature rise |

1.5˚C |

3.0˚C |

4.5˚C |

|

Change in average annual loss (AAL) for: The whole UK |

+11% |

+23% |

+25% |

|

Scotland |

+1% |

+10% |

+10% |

|

Northern Ireland |

+41% |

+59% |

+62% |

|

North East England |

+4% |

+16% |

+17% |

|

North West England |

+13% |

+26% |

+29% |

|

Yorkshire and the Humber |

+28% |

+45% |

+49% |

|

Wales |

+4% |

+15% |

+17% |

|

East Midlands |

+27% |

+42% |

+45% |

|

West Midlands |

+37% |

+53% |

+54% |

|

East of England |

-6% |

+3% |

+4% |

|

London |

-16% |

-8% |

-7% |

|

South West England |

-10% |

-1% |

+1% |

|

South East England |

-20% |

-12% |

-11% |

The worst wind storm to hit the UK in recent years is the Burns Day storm (also known as Daria) on January 25th 1990 in which 47 people died. The insurance industry paid out £2.1 billion in claims, worth over £4 billion today, with damage worth millions more done to national infrastructure and uninsured properties.

When looked at over the long term, floods and windstorms tend to result in similar levels of claims costs for the insurance industry, but while floods create lower numbers of expensive claims, wind damage affects far higher numbers of people less severely.

Matt Cullen, Head of Strategy at the ABI, said:

“In the midst of all the other global uncertainties, it is important we don’t overlook the inevitable long-term impacts of climate change. Concerns about global warming often focus on rising water levels and the threat of flooding but this new research makes it clear the impact of other meteorological events such as high winds must not be overlooked.

“Severe storms result in claims costing billions of pounds. The likelihood of these claims increasing in the future is something the insurance industry, and society, need to start preparing for now. Planners and builders should be aware of the need for more wind-resistant construction in specific areas of the country if claims are to be kept to a minimum and residents spared the distress and expense of higher levels of wind damage.”

Dr Peter Sousounis, Assistant Vice President and Director of Meteorology, AIR Worldwide, said:

“The latest findings from the climate change science community show that just a few degrees of global warming could potentially yield significant increases in the frequency and intensity of extratropical wind storms across the UK by the middle of this century and will likely continue into the next century. This report illustrates that there will likely be increasingly large impacts from an insured loss perspective. It can also be a useful tool for the engineering community, urban planners, and the insurance industry to consider the potential impacts of climate change as they look toward the next few decades from a public safety as well as a business perspective.”

The full report is available here.

Notes for Editors

1. Enquiries to:

Malcolm Tarling 020 7216 7410 Mobile: 07776 147667

Lauren Gow 020 7216 7327 Mobile: 07889 641702

Sarah Cordey 020 7216 7375 Mobile: 07860 189071

2. The Association of British Insurers is the leading trade association for insurers and providers of long term savings. Our 250 members include most household names and specialist providers who contribute £12bn in taxes and manage investments of £1.6 trillion.

3. AIR Worldwide (AIR) provides catastrophe risk modeling solutions that make individuals, businesses, and society more resilient. AIR founded the catastrophe modeling industry in 1987 and today models the risk from natural catastrophes, terrorism, cyber attacks, and pandemics globally. AIR Worldwide, a Verisk Analytics (Nasdaq:VRSK) business, is headquartered in Boston with additional offices in North America, Europe, and Asia. For more information, please visit www.air-worldwide.com.

4. An ISDN line is available for broadcast

5. More news and information from the ABI is available on our web site, www.abi.org.uk.