Why motor insurers use age when pricing cover.

There are a large number of different rating factors used in setting the price for motor insurance. These include factors associated with the vehicle, where it is kept and the people who drive it. For the latter, age can materially influence both the likelihood of policyholders making a claim and the cost of such claims when they occur.

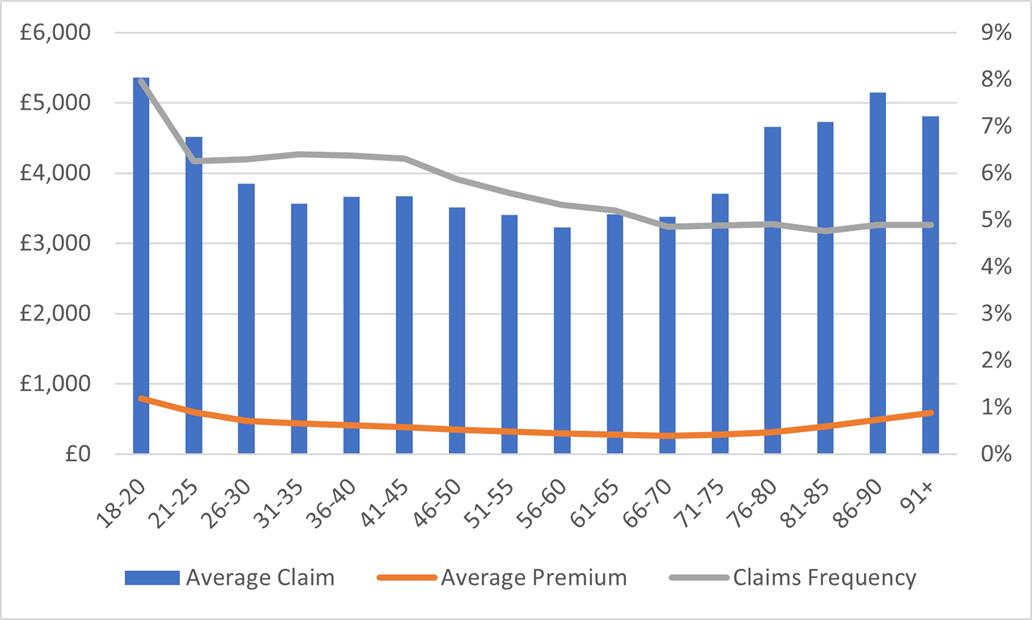

Impact of age on motor insurance claims and premiums

Chart One shows the percentage of customers claiming per policy, the average cost of a claim and the average premium for different age groups for private motor insurance in 2021 for people aged 18-20, 21-25 and so on in five year bands until age 90. All policies for people aged 91 and over have been grouped together.