Attitudes to mental health are changing for the better: 67% of people in Britain feel society is more comfortable talking about mental health conditions now compared to 5 years ago. At the same time, the incidence of depression has increased by a fifth in the space of 10 years, with latest figures showing that 3 million adults are on GP registers for depression. It is unclear whether this is because more people are affected, or because people are more open about their problems with a GP. Whatever the reason, the need for further progress in tackling mental health conditions is clear.

Attitudes to mental health are changing for the better: 67% of people in Britain feel society is more comfortable talking about mental health conditions now compared to 5 years ago. At the same time, the incidence of depression has increased by a fifth in the space of 10 years, with latest figures showing that 3 million adults are on GP registers for depression. It is unclear whether this is because more people are affected, or because people are more open about their problems with a GP. Whatever the reason, the need for further progress in tackling mental health conditions is clear.

The insurance sector also has a role to play here given it touches millions of lives: we can help with early intervention and specific product offerings, but also by improving how we interact with customers, and leading the way in how our sector treats its own employees.

Income protection goes beyond plugging a salary gap

Our latest protection claims statistics showed that, in 2018, around £85 million was paid through income protection insurance to support people suffering with mental health issues.

And paying their salaries whilst they’re off work recovering is only one aspect of what insurers do. Relieving consumers of the financial stress of being unable to work is vital, but providing the support they need to resume their everyday lives as far as possible is perhaps even more important.

GRiD found recently that Group Income Protection insurers recorded more than 75,000 interactions with employees through services like Employee Assistance Programmes or fast-track access to counselling. Each of these interactions help to potentially avert a more serious illness, or better yet - prevent absence from work in the first place. GRiD also reported that, thanks to additional services provided through Income Protection, thousands of employees were able to return to work after a period of mental ill health.

The Office for National Statistics has said that as much as 13% of all sickness absences in the workplace can be attributed to some form of mental health issue – costing the UK economy up to £8 billion each year. Spotting these issues early on and providing prompt support can make a huge difference – benefiting the individual, their employer, the insurer, the taxpayer (in the form of lower welfare payments) and the economy.

Changing the way we interact with customers

But paying claims and supplying services can only be the start. In the past two years the ABI has brought insurers together to examine the accessibility challenges mental health sufferers may face when applying for and claiming on their insurance. Our newly formed Mental Health Working Group is examining how insurers could change the way they interact with customers when they first apply, to ensure that questions posed in the application process are tailored and non-triggering toward consumers.

Similarly, when a customer comes to make a claim on any form of insurance, if they are known to suffer from mental ill health, insurers are looking at how to improve their ‘claim pathway’ so that the customer does not have to disclose their mental health condition several times as they navigate a call centre.

Insurers walking the walk

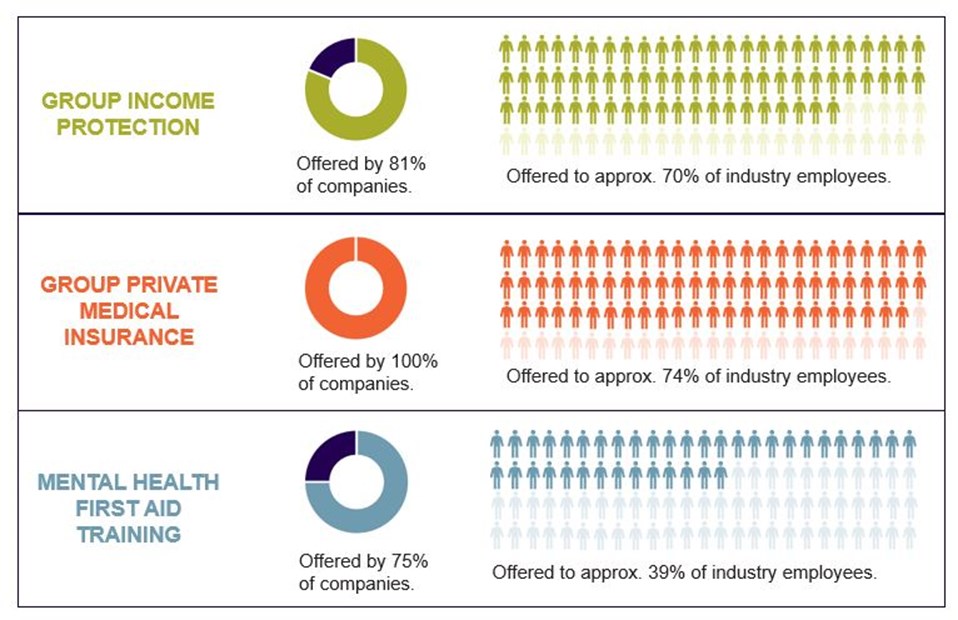

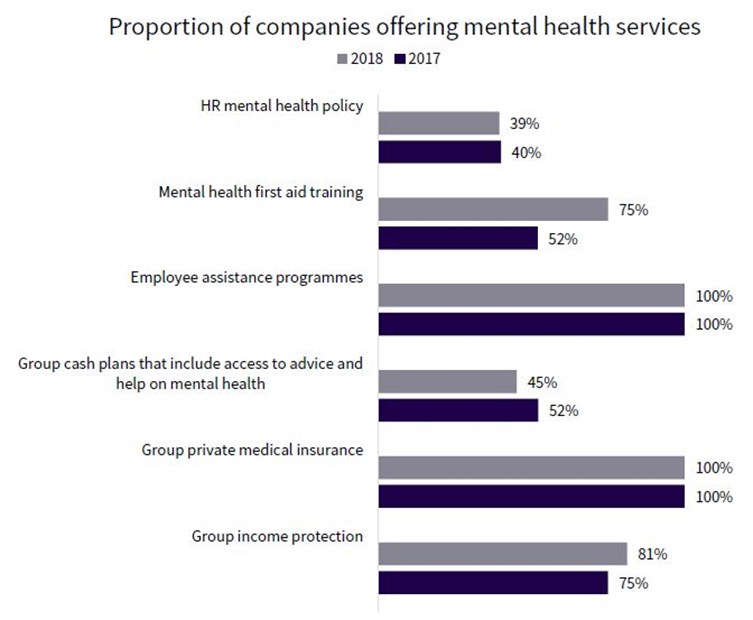

Finally, insurers recognise that they need to lead by example. By offering excellent support services, mental health first aid training, group income protection insurance and assistance programmes to their own employees, insurers are encouraging change from within.