Ahead of the ABI's 2020 Fraud Conference, Catherine Burt, National Head of Counter Fraud and head of the Motor Fraud team at our event partner, DAC Beachcroft, has blogged for us on the potential impacts of COVID-19 on increasing fraudulent claims.

Catherine Burt is the National Head of Counter Fraud and head of the Motor Fraud team at DACB Claims Ltd. She has worked in the Defendant Personal Injury arena for many years with a background in complex and high value casualty claims before moving into counter fraud work when she joined DACB in 2008.

Catherine Burt is the National Head of Counter Fraud and head of the Motor Fraud team at DACB Claims Ltd. She has worked in the Defendant Personal Injury arena for many years with a background in complex and high value casualty claims before moving into counter fraud work when she joined DACB in 2008.

COVID-19: Fertile ground for claims farmers?

Has there ever been a year of more change? The unthinkable has happened – schools have closed, offices are empty and holidays abroad are subject to changing restrictions. But what has the pandemic meant for insurance fraud?

There is no doubt that once the furlough schemes are over and the recession bites we can expect increased opportunistic fraud, with consequences for all lines of business.

But what about those who farm claims for profit?

First of all, what actually is claims farming? It basically involves a person or company encouraging someone else to make a claim, and where there is a legitimate claim to be made there is no issue with the practice. However, there will not be many of us who have not received a phone call or message about a road traffic accident we have not had, for example. Sometimes individuals are persuaded to make personal injury claims when they have not been injured, and at other times the farmers bring the claims without the knowledge of the individual concerned.

How is the pandemic affecting the farmers?

Well there have been fewer motor claims to farm, with fewer cars on the roads and fewer accidents to target.

But the farming business must go on. Insurers will be seeing old claims which they thought had gone away being recycled and re-appearing, just in case persistence will attract an offer.

And old data will be trawled for any other claims from the last three years which can be brought before limitation expires. There is a good chance that opportunistic fraudsters will appreciate the windfall of a personal injury award for an accident where there were minimal or no injuries.

A whole new work stream from COVID-19 related claims?

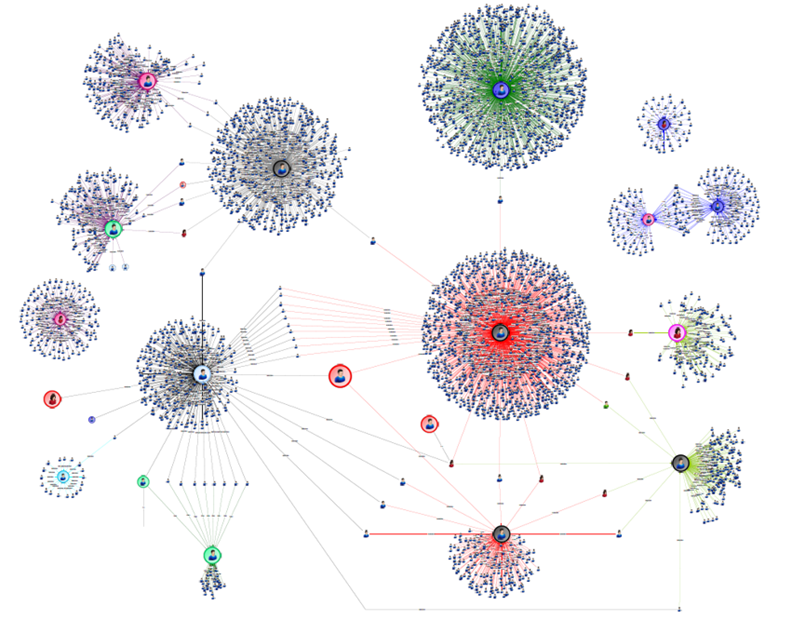

In March, our Intelligence team began tracking new companies created with ‘Claim(s)’ and ‘Coronavirus’ or ‘COVID-19’ included in the company name. By month end, Companies House showed five. Further investigations showed these to all be the product of company aggregators, not entrepreneurs in the claims industry.

By July, hundreds of such named companies were in existence, dozens of which appear to relate to the management of injury claims. Whilst many of these companies link back to company aggregators, some could be tied to large claims management companies (CMCs). Regrettably, a number of the new companies are already under investigation by law enforcement and the IFB, due to links to known fraudsters.