Families and firms could be £100 a year better off if the Government does the right thing and cuts the rate of Insurance Premium Tax

The Association of British Insurers (ABI) is urging the Government in its forthcoming Budget due on 6 November to cut the rate of Insurance Premium Tax (IPT) to ease the squeeze on families and businesses who do the right thing by taking out insurance.

The standard rate of IPT has doubled since 2015, most recently going up from 10% to 12% in June 2017. It applies to the vast majority of policies sold, including property, motor, health (including cash plans), pet and business insurance.

In 2017, research by the Social Market Foundation estimated that, if the standard rate of IPT had remained at 5%, its rate prior to 2011, then the savings per UK household could be significant. For the fiscal year, 2017/18, they estimated that households were directly paying about £50 per year more as a result of higher IPT1. If the business costs associated with higher IPT are ultimately borne by households (either through higher prices or lower incomes/dividends), then the additional cost per household could be as high as £105.

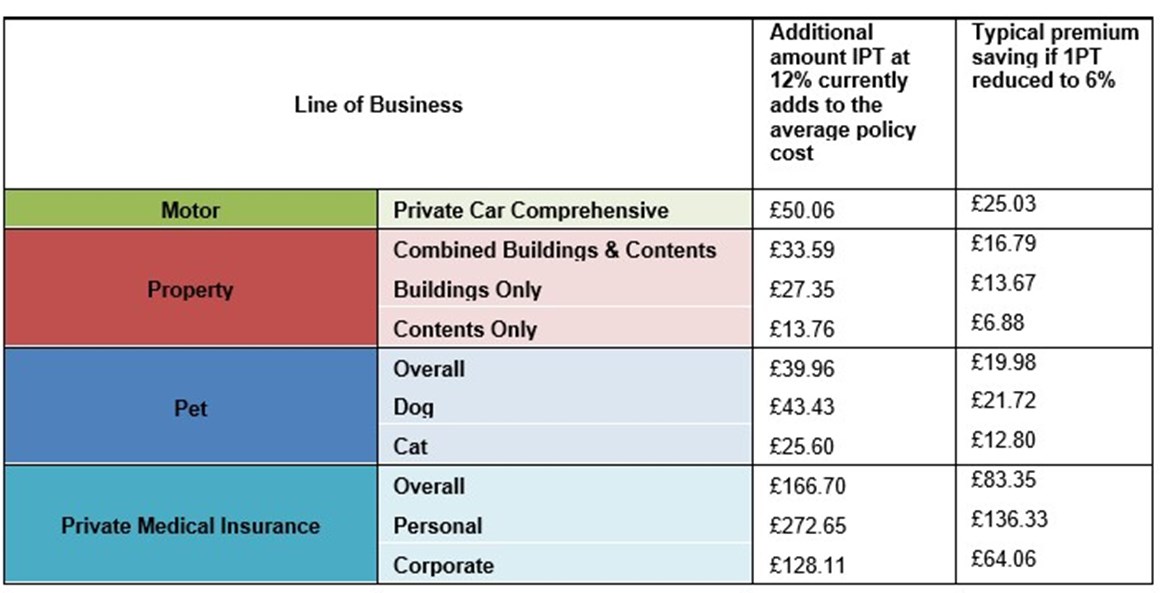

Here are the impacts of the repeated rises since 2015 on some commonly held insurance products:

“IPT has doubled to 12% since 2015, and responsible people deserve a break. This tax hits people on lowest incomes the hardest, as it applies to products most people need, or are required to have, such as home and motor insurance. Our rate of IPT is the 7th highest in Europe and hits our international competitiveness at a time when the UK needs to be making itself more globally attractive.”

“IPT has doubled to 12% since 2015, and responsible people deserve a break. This tax hits people on lowest incomes the hardest, as it applies to products most people need, or are required to have, such as home and motor insurance. Our rate of IPT is the 7th highest in Europe and hits our international competitiveness at a time when the UK needs to be making itself more globally attractive.”