Reassurance comes as latest figures show record payouts made by pet insurers

The ABI is reassuring pet insurance customers that its pet insurance members will be offering enhanced help and support through a number of pledges to customers who may understandably be concerned about the health of their pet during the Coronavirus outbreak. This reassurance comes as latest figures highlight how important pet insurance is, with insurers having paid a record £815million last year, mainly to cover veterinary bills, double what was paid out ten years ago.

The commitments include insurers taking a flexible approach on policy terms and conditions, such as any requirement for pets to have routine vaccinations, as many vets may only be open for emergency treatment. They will also have business continuity plans to deal with claims as quickly and as smoothly as possible. They follow similar commitments made by motor, household and travel insurers to provide enhanced support to customers during this worrying time.

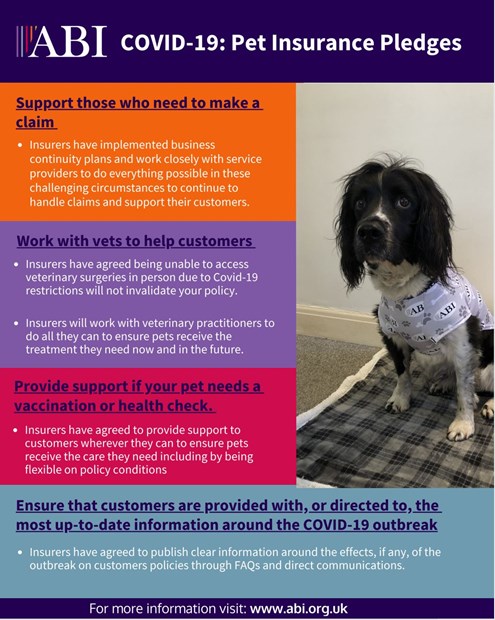

Pet insurers have committed to:

- Support those who need to make a claim. Insurers have implemented business continuity plans and work closely with service providers to do everything possible in these challenging circumstances to continue to handle claims and support their customers.

- Work with vets to help customers. Insurers recognise that access to veterinary surgeries is limited and have agreed that being unable to access veterinary surgeries in person due to Covid-19 restrictions will not invalidate your policy. Insurers will work with veterinary practitioners to do all they can to ensure pets receive the treatment they need now and in the future.

- Provide support if your pet needs a vaccination or health check. Insurers have agreed to provide support to customers wherever they can to ensure pets receive the care they need including by being flexible on policy conditions, in particular the requirement for pets to have up to date vaccinations and regular dental examinations.

- Ensure that customers are provided with, or directed to, the most up-to-date information around the COVID-19 outbreak and publish clear information around the effects, if any, of the outbreak on customers policies through FAQs and direct communications.

This reassurance comes as latest ABI figures out today highlight the value of pet cover to the 7.7 million pet insurance customers.

In 2019, pet insurers:

- Paid a record £815 million in claims, mainly to cover the costs of veterinary treatment. This is the highest figure on record, and double the amount paid ten years ago.

- There were 992,000 claims, the second highest annual number on record. Of these, 211,000 were for cats, 749,000 for dogs, with payouts totalling £136 million and £622 million respectively

- The value of the average payout was £822, up £20 on the previous year. Despite this, the average pet insurance premium, at £271, fell by £8 on the previous year.

Examples of how much it can cost to treat an ill pet, include:

- Over £40,000 paid since 2010 that covered a series of treatments for a terrier with a serious congenital lung disorder under ‘covered for life policy’

- £7,000 to treat a French Bulldog that had fractured its leg.

- £5,000 to reattach two toes to a cat after they had been crushed.

Mark Shepherd, Assistant Director, Head of General Insurance Policy, at the ABI, said:

Mark Shepherd, Assistant Director, Head of General Insurance Policy, at the ABI, said:

“At this worrying time, pet insurers are doing everything possible to ensure that customers have all the help and support that they need. In particular, they will be flexible on policy requirements for certain routine check-ups or vaccinations, where it may not be possible to access veterinary services because of Covid-19. They also want to ensure that pet owners can still access any vital vet treatment that may be needed and will work with customers to help support this.”