Scale of pensions blind spot exposed: 1 in 5 people do not access information about their pension

27/02/2020

- Demand for digital pension access but different generations prefer different platforms.

- To maximise consumers’ pensions engagement, Pensions Dashboards need to be offered by providers across the public and private sector.

Nearly 1 in 5 people (19%) do not access information about their pensions, according to a survey commissioned by the ABI with Populus. The pensions blind spot could lead to people not getting the retirement they hope for.

The ways in which people currently interact with their pensions varies across the generations with people using a mix of digital, post and phone. The polling comes as the Pensions Schemes Bill makes its way through Committee Stage in the in the House of Lords, a key milestone to make Pensions Dashboards a reality.

The polling on pensions engagement and how people want to access all their pensions in one place shows:

Digital is king for convenience

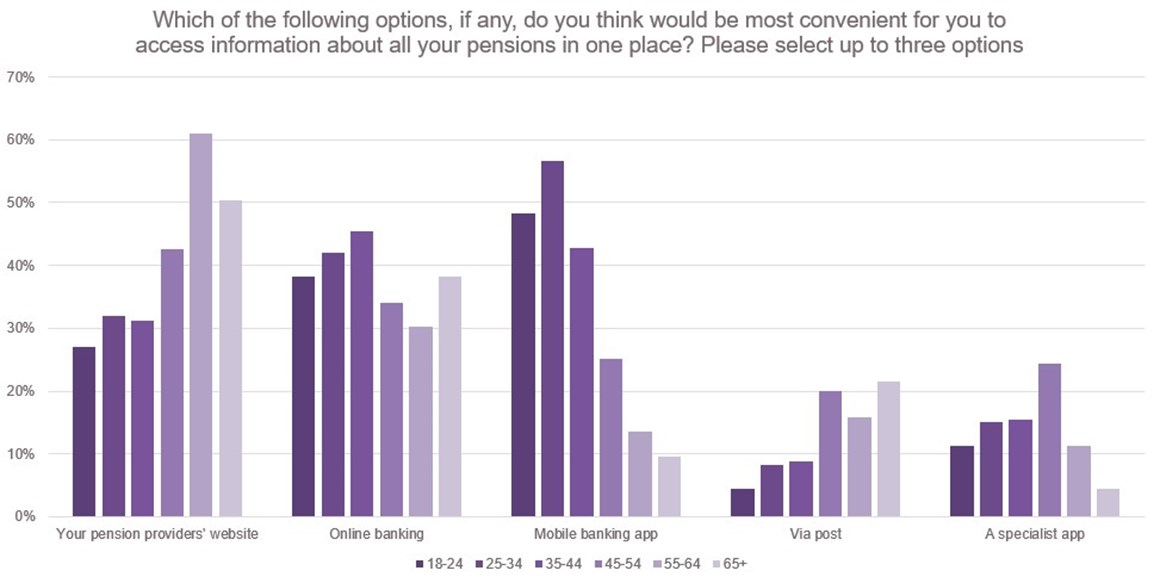

When asked about what three ways would be convenient to access your pensions in one place, going online comes out on top. But the platform preference varies between generations, highlighting the need for multiple dashboards.

- 18 - 34 year olds prefer a mobile banking app – 54%

- 35 – 54 year olds prefer online banking – 41%

- 55 and overs prefer their pension providers website – 54%

Result: No clear winner on preferred digital platform

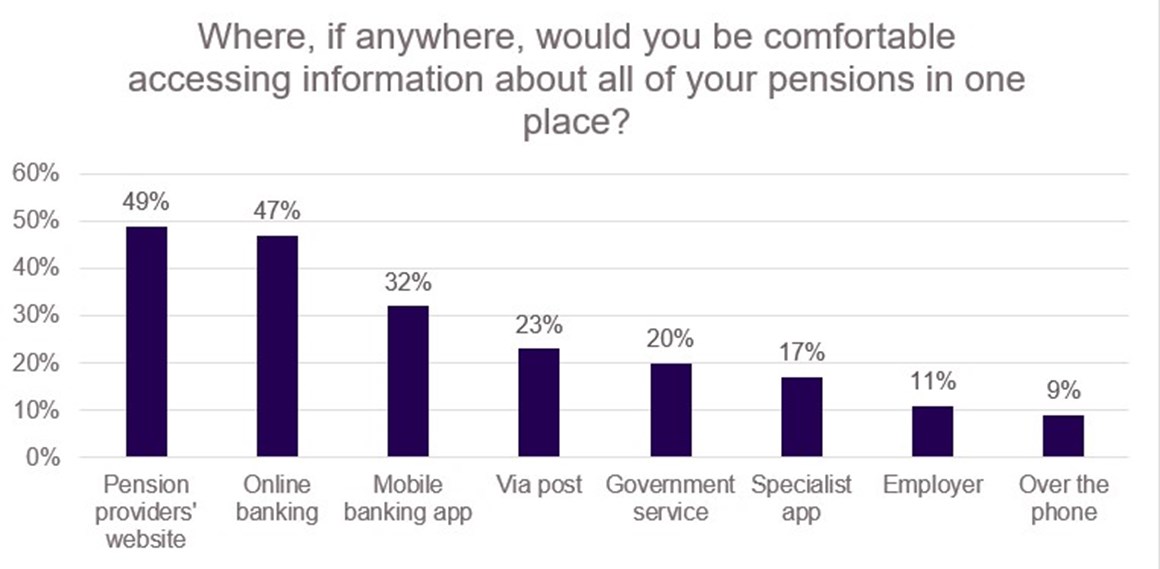

Asked where they would be comfortable accessing the information about all of their pensions in one place, 20% of people would want to access the information through a government service, while 49% of people prefer their pension provider.

With a demand for digital information, multiple pensions dashboards will enable people to see all their pensions in one place through a platform of their choosing and help discover lost pension pots.

It is estimated that 1 in 5 adults admit to having lost a pension pot*. Research by the Pensions Policy Institute (PPI) suggests these are worth at least £19.4bn. Without Pensions Dashboards, the Department of Work and Pensions estimates that 50 million pensions pots will be lost or dormant by 2050**.

Rob Yuille, Assistant Director, Head of Long-Term Savings at the Association of British Insurers said:

“People need support to engage with their pensions to make sure their retirement lives up to their expectations. Pensions Dashboards will be critical to achieving this.

“People need support to engage with their pensions to make sure their retirement lives up to their expectations. Pensions Dashboards will be critical to achieving this.

“To make it easier for people to engage, both Government guidance services and private companies, like pension providers and banks, need to be able to offer Pension Dashboards. Employers, charities and trade unions could also provide these services, so that people can access the information wherever is comfortable and convenient for them.”

-ENDS-

Notes for Editors

- Populus surveyed 2,008 consumers across the United Kingdom between 22nd and 24th November 2019. The full results tables can be found on the ABI website.

- *Figure based on research by the Pensions Policy Institute, which can be found here.

- **DWP figures available here.

Enquiries to:

Malcolm Tarling 020 7216 7410 Mobile: 07776 147667

Laura Dawson 020 7216 7338 Mobile: 0772 5245838

Su Crown 020 7216 7412 Mobile: 0772 5245297

- The Association of British Insurers is the voice of the UK’s world leading insurance and long-term savings industry.

- A productive, inclusive and thriving sector, we are an industry that provides peace of mind to households and businesses across the UK and powers the growth of local and regional economies by enabling trade, risk taking, investment and innovation.

- An ISDN line is available for broadcast. We have spokespeople available.

- More news and information from the ABI is available on our web site, abi.org.uk.