Background

Pillar One of the ABI’s Roadmap focusses on the actions ABI members need to take to align their portfolios to Net Zero – focussing on the ‘financed emissions’ that are linked to investment and underwriting activity.

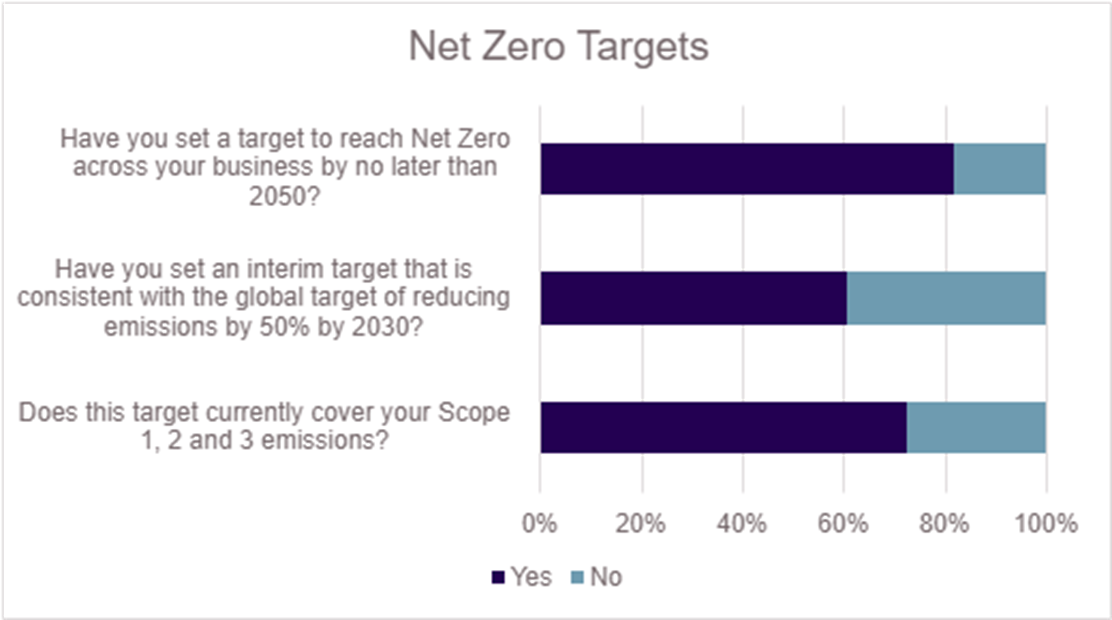

This pillar outlines how the sector will meet its commitment to reaching Net Zero by 2050 - in line with the Long-Term Global Goal (LTGG) agreed in Article 2.1 of the Paris Agreement and reaffirmed at COP26 and to halving our emissions by 2030, in line with the conclusions of the IPCC's Mitigation report, published in April 2022.

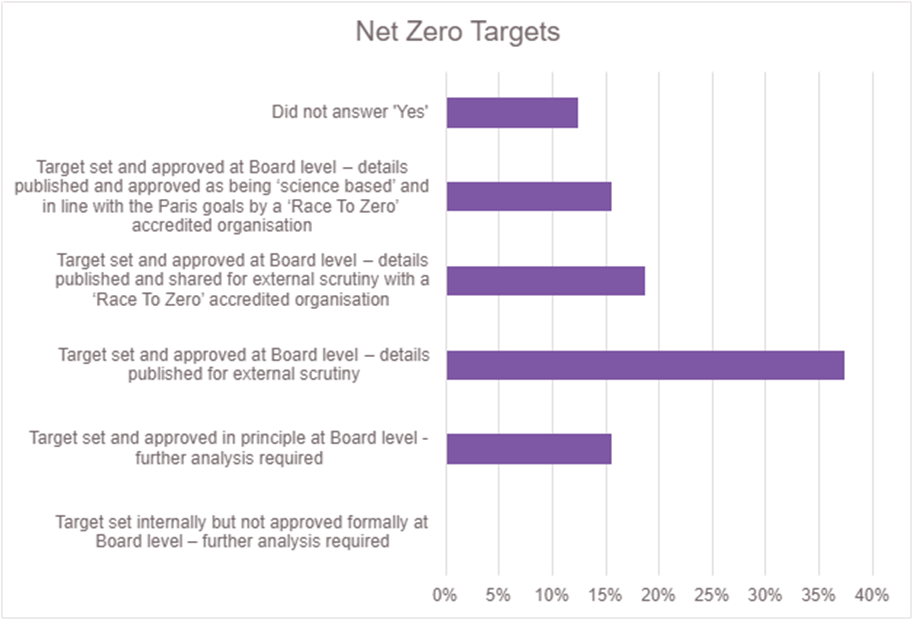

This pillar emphasises the importance of transparency and external scrutiny. This is how climate change experts can scrutinise whether the commitments ABI members are making are credible and how our stakeholders can ensure the actions we are taking align with Net Zero strategies in the wider economy.

To achieve this, the ABI recommends that its members join an organisation that has been accredited by the UN-backed Race To Zero campaign.

- ‘Race To Zero’ is a global campaign to rally leadership and support from businesses, cities, regions, universities and investors for a healthy, resilient, zero carbon recovery that prevents future threats, creates decent jobs and unlocks inclusive, sustainable growth.

- Initiatives ABI members can join include one of the Glasgow Financial Alliance for Net Zero (GFANZ) groups, or related initiatives like the SBTi (Science Based Targets initiative)’s Business Ambition for 1.5 campaign or the IIGCC (Institutional Investors Group on Climate Change)’s Paris Aligned Investment Initiative.

In addition, our Roadmap sets out a series of milestones that we expect ABI members to achieve by 2025 – these are particularly important as they are within the tenure of the industry’s current leadership. The group of industry CEOs who developed our Roadmap have consistently emphasised the need for milestones they can personally be held to account for, to ensure that their businesses are able to meet the longer-term 2030 and 2050 targets.

Progress Update: What has been achieved in 2021/22

Since publishing our Roadmap in July 2021, the ABI has focussed on encouraging as many of our members as possible to take action to set Net Zero targets.

We have seen significantly progress since then – customers who are looking for a new Insurance or Long-term Savings provider are now able to choose from a large number who have been accredited by the UN-backed Race To Zero campaign.

Since we first published the ABI Roadmap, we have seen more members become accredited as part of ‘Race To Zero’ – this means that, as a proportion of the overall marketshare represented by ABI members, 89% of the Long-term Savings market and 54% of the General Insurance Market are part of the ‘Race To Zero’2.