“Many disabled adults and older people continue to be denied choice and control over their lives”, a recent Lords report found.

The Social Care Future inquiry also showed that people who need care often lack control over the support they receive and can be placed in one-size fits all institutions.

Far-reaching and well-funded reform is needed to give those who draw on care and their families more choice and control. However, the insurance and long-term savings industry also has a part to play in helping people meet their care and care-related costs so they can get the support they decide they need. To do so, several barriers need to be addressed, and our recent report sets out how to tackle these.

The role of the industry

Paying for care always requires both public and private funding and the industry’s role is to offer financial solutions to those who want more than what the state can offer them.

Financial products are meant to complement rather than replace the state, as they could give more choice, more control, more respite for unpaid carers and allow more independence for those who want to live in their own home for longer.

Getting services beyond what the state offers is often misunderstood as being a bit of a luxury, like choosing a better, nicer room. However, wanting more than what you’re eligible for from local authorities can be quite basic.

For example, according to Age UK, in 2019 one in seven people aged 65+ were struggling without the help they depended on to carry out essential everyday activities.

For example, according to Age UK, in 2019 one in seven people aged 65+ were struggling without the help they depended on to carry out essential everyday activities.

Stakeholders have also told us of people who are eligible for only a few minutes of home care time. Being able to use top-up payments to have help with an extra shower a week, for example, is far from a luxury.

Having the option to pay a top-up to get more support will be a positive change to the rules under the 2021 proposed reform. It is important that these financial solutions are accessible to as many consumers as possible.

The historical challenge of creating a market

Creating a market for products that help pay for care is a challenge in itself. From a demand point of view, people naturally find it hard to think of themselves being in a position of needing care; they often underestimate the cost of care or assume it is freely provided in the same way as NHS health care; they often can’t easily understand what they would be entitled to and what they need to provide for themselves; and people also delay making financial plans until there is clarity and certainty over the reform.

For insurers specifically, quantifying the risk is also difficult. For instance, it requires predicting medical progress and longevity and there are unknowns such as individual family arrangements, policy changes and interaction with other policy areas, including housing. Although these are not fundamental barriers to development of a market, they remain limiting factors.

Financial solutions meet many consumers needs, but face several challenges

In our report Prepare for Care, we took a fresh look at financial solutions and the needs of people who use social care.

We found that some of the key consumer needs are:

- affording to pay extra to have more choice over their care package,

- mitigating or delaying the need to move into residential care,

- and support for unpaid carers.

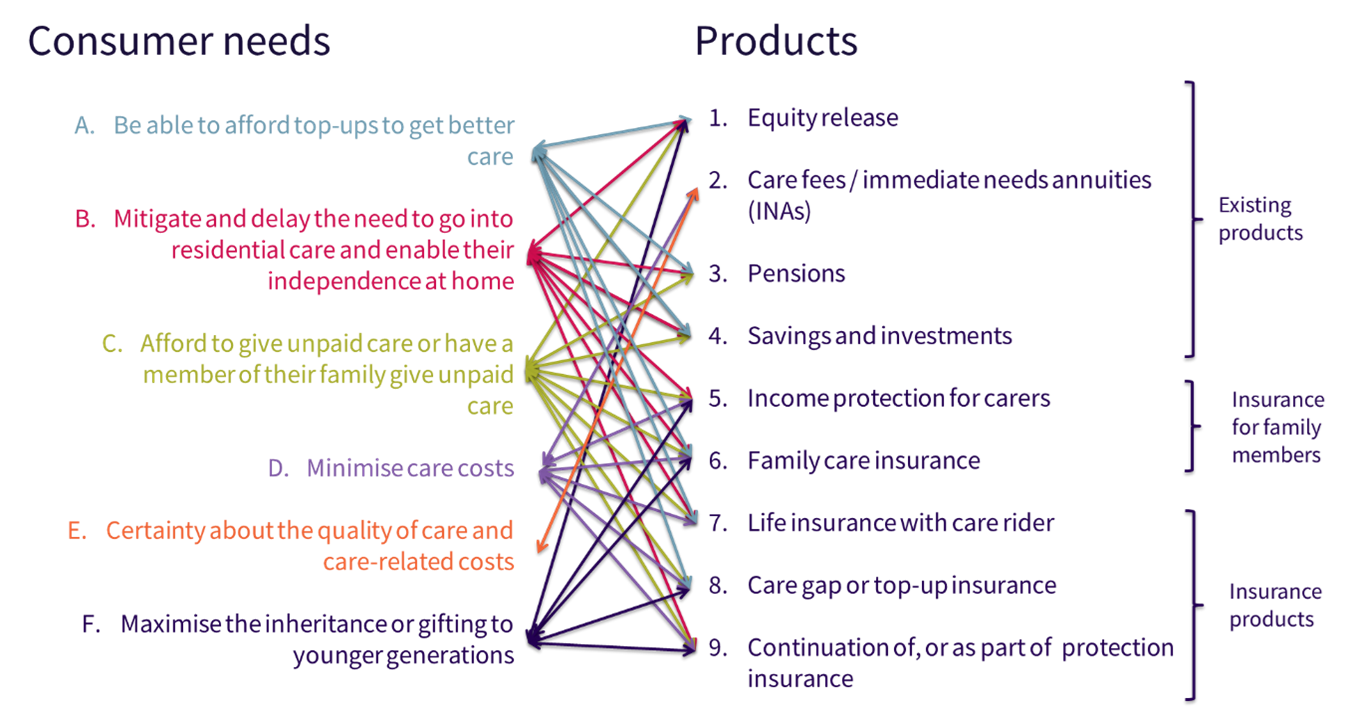

We showed how current and potential financial products, including pensions, investments, insurance and property, can help people meet these needs.

As the diagram below shows, multiple products can meet multiple needs – there is no single solution.

However, the report also sets out several barriers to developing or selling such products.

The proposed means-test rules are more generous and will therefore mean that more people don’t pay for care at all. But in terms of interaction with financial products, the rules are a key problem identified by the research we commissioned from the Pensions Policy Institute. This would see two thirds of the population lose out on local authority support should they receive a pay-out from an insurance product. This is because the local authority would consider any payment from a policy as part of an individual’s income or assets. As a result, their local authority support would be reduced or even cancelled.

Only a very small group of people, mainly those with an already high level of income and/or savings, would see the full benefit of a pay-out. Those on lower incomes would be disadvantaged and it would be difficult, if not impossible, for advisers or providers to know if a person would be one of the third of the population that would be unaffected. This is likely to make the product fail the regulatory ‘fair value’ test. To address this, we proposed excluding insurance pay-outs from local authority assessments.

Another barrier is that larger pension withdrawals can be taxed at a high marginal rate of 40% or even 45%. This may make pensioners reluctant to invest in adaptations to remain more independent and delay moving into residential care. It also discourages them from buying an immediate needs annuity, which would give them more assurance that they can afford their care indefinitely. To address that, we suggested scrapping or limiting tax on pension withdrawals if funds are used for care related purposes.

Stakeholder discussions

We launched our report at a stakeholder roundtable which gathered experts from the care and financial industry, academics and think-tank representatives.

The financial solutions discussed received much interest, especially the idea of family care insurance, which reflects the reality that often those who navigate the care system are spouses and children of those who need care.

This solution would pool risk and help manage the costs if the parent eventually needs care, but would complicate the design of the product as the policy holder would not be the person drawing on care. Also of interest was the idea of income protection for carers, which could give support and some respite to unpaid carers.

However, experts appreciated the challenges to creating a market. They raised the difficulty of getting people to think about social care in advance and considering these financial options. They also emphasised the complexity of the system, the rules and the interaction between local authority eligibility framework and products. Germany’s example was mentioned, where the private insurance market is aimed at younger healthier people, and rules are much clearer and standardised, but take up remains low.

Many agreed that greater awareness of social care and potential future costs is needed, as well as access to specialist help in advance and when care is needed. There was also scepticism that people will consider preparing for care, when pension contributions remain a challenge.

How to prepare for care

With the implementation of the reforms now delayed until 2025, the Government should take advantage of the current delay and address the issues we identified so that insurance and long-term savings products could help more people pay for care.

To help people consider their financial options and prepare for care, the Department of Health and Social Care (DHSC) should also run an awareness campaign once the policy framework has been identified.

In light of the complex local authority rules, and the complex nature of the financial options and interaction with different areas of policy, people will also need support and guidance. The Money and Pensions Service (MaPS) should have a crucial role in answering people’s questions and helping them navigate their choices. To be more effective, MaPS and providers should also be allowed to go further than they currently can within financial advice rules, and tailor guidance to consumers, their circumstances and preferences to help them to get to the right outcome.

For our part, we will continue to engage with the Government and other stakeholders and highlight the role that we can play if barriers are addressed. Everyone wants choice and control over their lives and suitable preparation helps us get the care we want.